Rising costs are taking the shine off the recovery of the tourism industry, notes the head of Hospitality sector at Bank of Ireland Gerardo Larios Rizo.

Record top line performance has been reported to date by hotels across the country, however operators continue to express concerns about profits due to sustained increases in costs and expenses particularly around staffing and energy.

“A growing number of businesses are evaluating the benefits of the various ‘green’ certifications available in response to customer concerns regarding responsible and sustainable business practices”

2023 H1 Insights

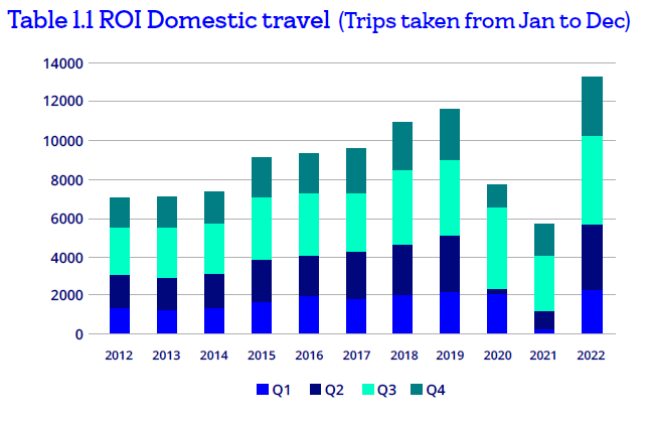

Strong trade figures reported by majority of businesses in the tourism industry so far this year. Fáilte Ireland’s May 2023 tourism barometer indicates that 53% of businesses have had more visitors this year compared to 2022 and 56% expect more visitors in the remainder of 2023. The Central Statistics Office (CSO) reported double digit growth (14%) in Irish Domestic travel/trips (14%) for 2022 when compared to pre-pandemic data for year-end December 2019.

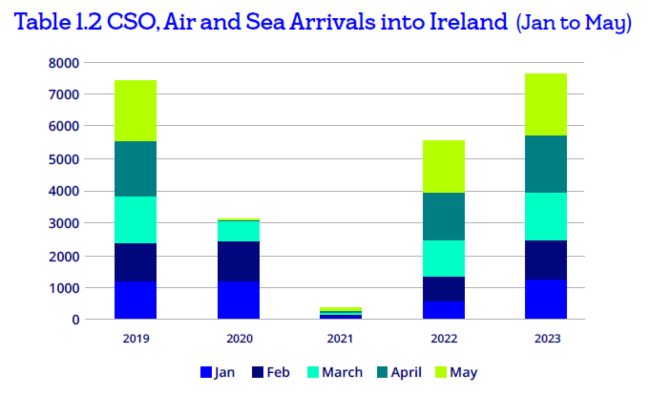

The return to normal travel patterns could soften the domestic demand travel trend in the coming months (increased domestic outbound), however, escalating numbers of overseas visitors could compensate any such shortfall. The recovery of air and sea travel capacity into Ireland has supported a 3% increase in arrivals so far this year (January to May 2023) compared to the same period in 2019; continental Europe arrivals top the list with an increase of 360k visitors for the period.

Cost pressures continue to threaten margins particularly on food and drink sales where pricing is more rigid, while generous average room rates reported to date in Ireland continue to support strong profits for accommodation providers. Hotel performance continues to benefit from a substantial amount of room stock in use for the housing of refugees (13% of registered accommodation as per latest Fáilte Ireland estimates).

Hotel sector key activity and trends H1 2023

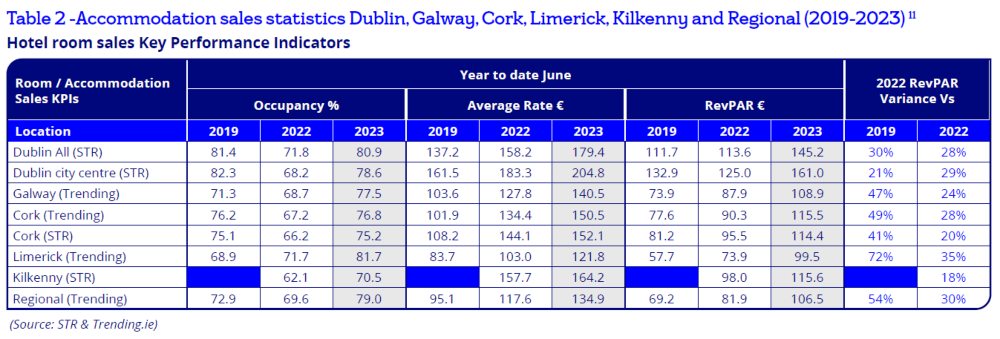

- Average hotel room rates remain on a positive trend around Europe with majority of European cities reporting double digit growth in Revenue Per Available Room (RevPAR)6 to the end of May 2023 (STR, CoStar May 2023 Data). All tracked locations in Ireland are reporting record breaking average room rates.

- Estimates on registered tourism accommodation facilities currently used for the housing of displaced Ukrainian citizens revised downwards from 28% to 13% by Fáilte Ireland in June 2023. There are five counties with over 20% of available capacity out of use for tourism: Offaly, Mayo, Leitrim, Meath & Clare. Clare tops the list at 33%, followed by Meath at 28%. At this point in time there is no indication from the Department of Children as to when these contracts might end.

- Average prices in Ireland, as measured by the Consumer Price Index (CPI), were 6.6% higher in May 2023 compared with May 2022. Restaurant and Hotel prices have increased a reported 8.9% during the same period. Escalating price trends in the sector influenced by strong demand as well as inflationary pressures; CPI for electricity gas & other fuels up c27% over the last two years.

- Air access to ROI reached 102% of its 2019 seat capacity for Q1 2023, compared to 92% for Europe. Air Arrivals into Ireland for the 5 months to May 2023 were up 3% on the same period in 2019.

- Hotel sector transactional activity has been strong in Ireland with €155m worth of asset sales completed so far this year (JLL, Daniel O’Connor, JLL Ireland Hotel Investment Market: Q2 23 Update). A sizeable volume of deals are nearing completion and a number more are under consideration. Largest deal completed this year was the sale of Brooks Hotel in Dublin city for a reported €50m acquired by MHL group.

- Whilst alcohol consumption in Ireland has been on a sustained decline, there are increasing number of businesses reporting an increase in the sale of alcohol-free beers and spirits; a recent survey from Kantar indicated a surge of 64% in sales in the UK.

Accommodation sales key performance metrics H2 2022

- Galway City. Average Hotel RevPAR from period Jan to June 2023 up €34 (47%) compared to the same period in 2019. A 6% increase in occupancy delivered hand in hand with a €37 increase in average room rates

- Limerick City continues to benefit from displaced demand from neighbouring County Clare where 33% of registered accommodation is out of circulation (Ref 4). A 72% increase in RevPAR reported in the 6 months to June 2023 compared to the same period in 2019; a 13% increase in occupancy for the period is supporting a €38 increase in average room rate.

- Cork City. Despite a low increase (2%) in occupancy for the period of Jan to June 2023 compared to 2019, the city reported a €49 (48%) increase in average room rate for the same period driving a 49% increase in RevPAR.

- The Irish capital has reported a strong H1 2022, on par with major European capitals. RevPAR growth led by strong average room rates with an increase of €33.5 (30%) reported in the six months to June 2023 compared the same period in 2019. Occupancy is recovering but remains marginally lower than 2019 due to a combination of factors including number of events as well as an estimated 15% increase in bedroom supply.

Consolidation and brand penetration

- Key Transactions in the Irish Hotel market completed this year were all carried by well-established operators including Stanley Quek (Tulfarris), Louis Fitzgerald Group (Imperial Hotel), MHL Hotels (Brooks), Cliste (Springfield Hotel). The expansion of established hotel groups has been the norm for the last number of years, reducing the number of family owned/operated hotels in Ireland.

Among the larger Hotel Groups in ROI:

- Dalata, 28 Hotels (Maldron & Clayton) + 4 partners.

- TMR Collection, 15 Hotels.

- TIFCO, 11 hotels + 4 partners.

International Hotel brands continue to increase their foothold on the Irish market. Brands like Moxy, Point A and Easy Hotel have entered the market over the last couple of years with additional branded bedroom stock opening in Dublin and Cork in the near future.

Warehoused tax obligations

The interest free period on warehoused tax obligation balances with Revenue finished at the end April 2023; outstanding balances are now liable to a 3% interest charge. Businesses in Ireland have until May 2024 to agree a phased payment agreement (PPA) with revenue. The maximum phased payment arrangement is 36 months as per Revenue.ie. The repayment of these facilities will have a material impact in the cashflows of those businesses who availed of PPA in the coming year.

Lending activity

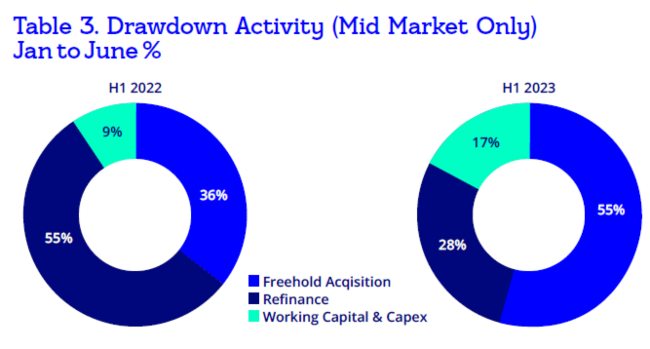

Positive business sentiment prevails in the Hotel and wider Hospitality sector with sustained transaction and financing activity in the market.

Over the last six months Bank of Ireland has continued to support customers in freehold acquisitions, refinances from other credit institutions and an increasing number of working capital facilities. Over the last six months we have noticed an increase in funding requests for acquisition of residential dwellings for staff accommodation as well as increased capital investment projects targeting decarbonisation following a surge in energy audits supported by the Sustainable Energy Authority of Ireland (SEAI).

2023 H2 Outlook

After a strong first half of the year, the outlook remains primarily positive in ROI with strong levels of business on the books reported on average by most locations. However, the anticipated increase in hospitality VAT which is set to revert to 13.5% at the end of September will have an immediate and material impact in profit margins if implemented; uncertainty persists about the potential exclusion of food sales as part of the review.

Hotel Sector Outlook for H2 2023

- Positive outlook for domestic demand in Ireland despite fears of an exodus of Irish holidaymakers. Encouraging employment trend in ROI with seasonally adjusted unemployment reported at 3.8% at the end of Q2, and strong household deposit balances (well ahead of the EU average, according to the IBEC Economic Outlook) give a level of confidence on the domestic leisure market.

- Pressure on profits. The increase in hospitality VAT and prevailing inflation will continue to present challenges to the hotel sector in Ireland.

- Increased focus on ESG credentials continues to influence investment projects. A growing number of businesses are evaluating the benefits of the various “green” certifications available in response to customer concerns regarding responsible and sustainable business practices.

- Unsolicited approaches for hotel asset acquisitions in Dublin and regionally likely to continue in the medium to short term, key players in the Irish market continue to seek expansion opportunities.

- Slight slowdown in development activity anticipated due to high construction and financing costs. Planned hotel developments in Dublin city are facing increased scrutiny; recent refusals have cited overconcentration.

The ESG agenda

Hotels and other types of accommodation are estimated to account for 2% of the 5% global CO2 emitted by the tourism sector (World Tourism Authority).

The Irish Hospitality industry has been implementing green initiatives since the late 1990’s. Actions first instigated by the promise of potential energy savings. In recent years, the changing landscape has led to a more proactive and comprehensive approach that looks beyond the savings and focuses on sustainability and social responsibility.

As we move forward, businesses will have to escalate their efforts and adapt their strategies to comply with both legal requirements and customer’s expectations. A variety of certs and programmes have evolved over and gather momentum over the years, including Green Hospitality Programme (Greenhospitality.ie), 50 Shades Greener Programme, and “Travel sustainable Programme” from booking.com (developed in collaboration with Sustainalize)19. More comprehensive certifications like B Corporation20 now sought by hotels like the Armada Hotel that received its B-Corp cert earlier this year.

Certifications for facilities like Excellence in Energy Efficient Design (EXEED) and Breeam are relevant for hoteliers involved in new developments and larger scale investment/retrofitting projects.