The pace, advancement and capabilities in emerging technologies particularly in relation to generative artificial intelligence (AI) continues apace, writes Paul Swift, head of Tech, Media and Telecoms Sector at Bank of Ireland.

New applications and tools are hitting the market almost on a daily basis, democratising the technology for the masses.

H1 2023 look-back

“The trend of consolidation continues across the managed service space and we were delighted to again support businesses continuing on their acquisition trail, bolting on more businesses, adding to their burgeoning suite of technology offerings and broadening their geographical footprint”

Technology

What a first half year it has been. Staggering to witness the pace of development in generative artificial intelligence (AI) and machine learning (ML) tools and the ensuing hype this has created. While ChatGPT only launched in November of last year, the internet has blown up with endless feeds on potential uses and examples of how businesses are integrating generative AI into their operations. ChatGPT recorded over 60 million visits per day in May or c1.9 billion (SimilarWeb) total monthly visits. Many are calling it a technology revolution and while that may be so, I think what we are seeing is the beginning of the democratisation of artificial intelligence. It’s widely accepted that it has the potential to transform entire industries and will become more intelligent over time. Thus, businesses can’t simply wait to see how this will evolve over the coming years. To maintain one’s competitive position and stay current, enterprises need to start focusing on creating a generative AI strategy of their own and focus on what it will mean for them and their business.

Media

Great to see the formal establishment of Coimisiún na Meán in March, which also saw the integration of the Broadcasting Authority of Ireland into this new Commission. The new authority has responsibility for implementing a new regulatory regime for online safety and protecting people from online harm not only in Ireland, but will also act as the regulator for all of Europe (working closely with the European Commission and counterpart agencies internationally). Given many of the large online platforms have their headquarters in Ireland, the Commission will be seeking to enforce the rules these organisations must follow in order to keep their users safe.

Its mandate also extends to regulation of broadcasters and streaming providers, enforcing standards and rules relating to age-appropriate content, gender balance and current affairs.

Similar to how the Data Protection Commissioner (DPC) has enforced compliance, we expect to see a similar proactive approach being taken by Coimisiún na Meán. They plan to recruit up to 300 staff, which in itself represents significant investment, commitment and a clear statement of intent on behalf of the state.

Telecoms

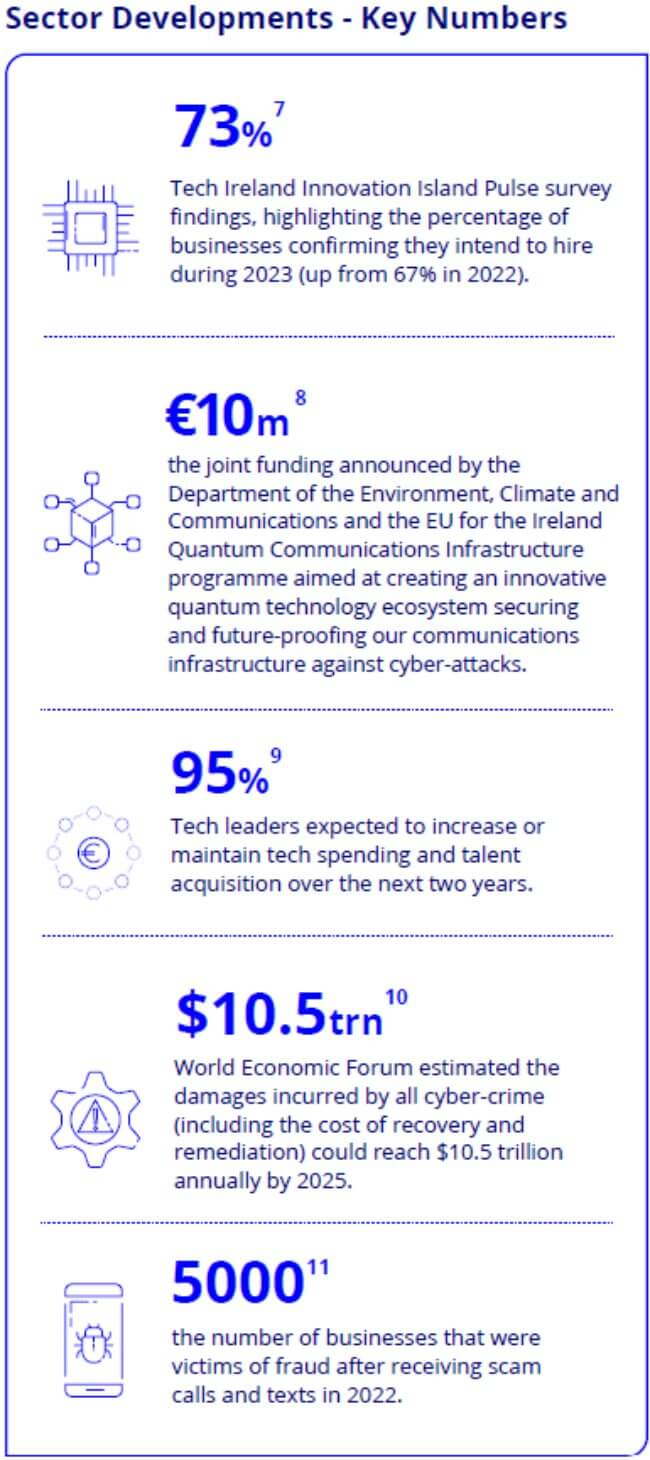

We’ve all been there, where we’ve received a text/call telling us that our data has been compromised or we’ve won a competition (that we can’t remember entering) and requires us to provide some personal information/data. Recent research commissioned by Ireland’s Commission for Communications Regulation (ComReg) illustrates the shocking extent of these scams. In 2022 alone in Ireland there were approximately 365,000 cases of fraudulent scams. The financial cost of these nuisance communications is conservatively estimated to be in excess of €300m (€115m scam texts and €187m scam calls) per annum. ComReg have in recent weeks published a consultation that proposes to mandate some potential network-based interventions to reduce the harm from scam calls and texts.

This would see the onus on operators to implement measures such as call blocking to prevent criminals purporting to use Irishbased numbers. There are also plans to roll out an SMS scam filter, but this will require change in legislation and ComReg have commenced engagement to move this forward. This development is welcome news as these scams erode the trust that consumers and businesses have in calls and SMS, damaging the benefits of these services. We await developments post the consultation closing date around the end of July.

2023 H1 Key Sector Trends

AI for SMEs: While it may seem like a relatively new concept AI has been around since 1956. A group of researchers in Dartmouth University in New Hampshire came up with the concept during a summer research workshop and called it artificial intelligence. Thus, recent developments amount to an “overnight success” after almost 70 years.

So, what does AI look like in our everyday lives? Take for example Netflix or Spotify can personalise content based on our behaviours which reduces the time searching and improves our experience. SMEs are now using the power of AI to help create personalised content such as marketing campaigns.

Likewise, we are seeing an increase in how many companies are collecting and analysing their customer data to glean information on behaviours, preferences, and demographics to create customised marketing messages that resonate with customers as individuals. Furthermore, chatbots are being trained on this personal information, automating more efficient customer service delivery. This approach which may have been seen as highly innovative only a few years ago and the preserve of large multi-nationals, is now available to any business through various off-the-shelf, AI tools and applications.

Metaverse – it hasn’t gone away: There has been lots of negativity in recent months following the decision by Mark Zuckerberg to shift focus from the metaverse to AI. Blockchain Ireland have continued to lead out on all things related to the Metaverse from showcasing the world’s first virtual Irish pub (where users could visit and discover Irish culture, arts and more), to how it can potentially revolutionise the fashion world (creating omniversal fashion experiences). Yet, it seems many Irish technology leaders remain unconvinced, with 66% of EY survey respondents stating that the metaverse will deliver little or no value at all to their organisations over the next two years.

The truth is that no one really knows exactly what the likely potential of the metaverse will be and its impact on our lives.

In summary, while the buzz around metaverse has receded somewhat, investment in the technology continues. In 2022, it was estimated that the global metaverse market stood at $65.5 billion dollars. Through 2023, this is expected to rise to $82 billion U.S. dollars, before surging to $936.6 billion by the end of the decade.

Digital Twins supporting sustainability: Digital Twin Technology (DTT) dates back to NASA during its space exploration missions of the 1960s. In recent years we have seen it used in manufacturing to trial and test numerous different scenarios, such as identifying/overcoming technical issues quicker. Similarly, it helps to make predictions on future errors or higher accuracy rates, avoiding substantial financial losses. Hence, the ability to use the technology to simulate alternate scenarios and implement the one that results in improved efficiencies will be invaluable to enterprises in their endeavours to achieve compliance. In a study by Cap Gemini, 60%6 of enterprises believe digital twin technology is critical to ESG efforts, not just in manufacturing but across supply chain, transportation and aviation sectors to name a few. As the adoption of digital technologies becomes more ubiquitous across all industry sectors, we will inevitably see an increase in the use of digital twins as an effective tool to help businesses with risk mitigation strategies in helping reduce greenhouse gas emissions and the associated carbon footprint of businesses.

Key activity in the Sector:

Stabilisation in tech job losses: despite having started the year in the middle of what felt like an endless stream of layoffs in the sector, as we move into the second half of the year, there has been lots of good news with recent tech-centric announcements of new jobs. We have seen companies such as Ryanair creating a further 100 technology roles, Deloitte are seeking to hire 300 roles, many of which are technology focused/ related, along with LibertyIT (100), AMD (290) Codec (65) ZF Group (25), Centripetal (50) and ServiceNow (400).

These and other earlier announcements have gone some way to quelling any anxiety that the sector was headed towards a prolonged decline. We are also seeing some of those companies that laid off staff, beginning to rehire for various roles. That said, the skills shortage and the need for a joined-up approach to upskilling is something that various trade associations continue to lobby for on behalf of the sector nationally.

Buoyant M&A: During the first half of the year, we have seen a marked uplift in activity for a combination of reasons.

Over recent months, we are seeing acquisitions being made, buying customer books to gain access to lucrative government contracts that are ‘sticky’, multi-year and difficult to displace.

These acquisitions drive increases in recurring revenue and are setting those businesses up to maximise multiple(s) on exit.

There is also evidence of larger companies making acquisitions seeking to fill product portfolio gaps in their technology suite.

During May, Bank of Ireland TMT team hosted an M&A themed event that was attended by 22 TMT CEOs from across Ireland who shared experiences of preparing for either buy-side or sell-side. It was fascinating to hear from those present about their learnings of the process and when is a good time to source funding. Based on those discussions, there is much to look forward to over the coming months.

National cyber training programme launched: a recent report by Cyber Ireland suggested that by 2030 the cybersecurity industry will be worth €2.5 billion employing over 17,000 people.

This report specifically called out the need to create a pipeline of suitable talent to meet future industry needs and support sustainable growth of the sector. This would require a joined-up approach through engagement with industry to ensure existing third level courses prepare students for careers in cybersecurity.

Other initiatives in the report referred to reskilling and retraining that could enable candidates from other industries to undertake transition courses to address the shortage of cyber skills. Hence a new national training cybersecurity training programme has been launched to support industry 4.0 by the Advanced Manufacturing Training Centre of Excellence (AMTCE). Courses are open to both individuals and employees of organisations and will be practical in nature. More information available here

Recent investment in the sector:

Venture capital funding up in Q1: good to see that Ireland is bucking the trend with Venture capital as funding into Irish SMEs rose by almost a third (32%) to a record €502m in the first quarter of 2023, compared to €380m in the same period last year, according to the Irish Venture Capital Association VenturePulse survey. Conversely, the value of deals in the €1m-€3m range fell by two thirds to €10m. Deals below €1m fell by 28% to €6.5m. Seed capital dropped 67% to €7.5m. These are worrying signs for the start-up/scaling sector as we continue to see a global slowdown in the venture capital sector.

With the correction in the market over the last year where valuations have become more realistic and investors eyeing businesses with balanced growth trajectories, this will inevitably impact decision-making of funders/CEOs. Profitable businesses have far more options when it comes to fundraising. Senior debt being one option, that is non-dilutive and with a low-cost of capital, this may well force founders onto a more sustainable growth trajectory, albeit perhaps slower growth, when access to venture capital continues to be constrained.

Fundraising over the first half of the year:

- Inscribe: the Dublin-based fraud detection start-up raised $25m in Series B funding where they planned to grow in Dublin and the US.

- NomuPay: the Dublin-based fintech start-up on a mission to simplify payments raised $53.6m in a funding round co-led by Finch Capital and Outpost Ventures.

- Everseen: the Cork-based computer vision and hyper automation solutions provider, announced €65m Series A follow-on funding round, led by existing investor Crosspoint Capital Partners

TMT H2 2023 Outlook

Technology

Looking ahead to the remainder of the year we anticipate further consolidation of the managed services space/technology consulting sector as businesses become more daring and seek to expand their use of technologies and to support efficiencies in a range of different functions from HR to customer support.

Managed services have benefitted from this trend and continue to perform strongly. Hence, we believe we will see more M&A activity in this space over the coming months and into 2024.

Media

Ever had a DIY issue at home or needed to fix a leak? Years ago, you might have phoned a friend or family member, but more recently, your first point of call may be a YouTube tutorial. Video has the capacity to be far more experiential and immersive.

For SMEs trying to build customer relationships, be heard and compete with big business can often be overwhelming especially given the size of advertising and marketing budgets those large enterprises have.

However social media platforms such as TikTok and YouTube are providing new ways to level the playing field for those SMEs.

This is why we are seeing more and more industries seizing the opportunity to engage with existing and potential new customers through the medium of video. Video marketing continues its rise in popularity with a reported 86%25 of businesses using it in their marketing plans. Businesses everywhere constantly strive to build their own niche communities of customers.

Creating content and promoting one’s business without being overly staged, including staff and telling a story of business in a simple way for up to 60 seconds, is authentic, fun, unique and different. Most of all, it enables businesses to be searched and discovered. We’ve all gotten over the shyness of being on video over recent years through endless Zoom, Teams and numerous other video calls, now is the time for every business to create their own content, get their teams involved and maximise the opportunity to have their 15 minutes of fame.

Telecoms

Vodafone recently announced a €500m investment in network upgrades over the coming five years. Their intention is to improve reliability of text and call traffic for customers by extending their 4G and 5G coverage across Ireland, while at the same time winding down their 3G network. This is a clear indication of how sustainability measures are being implemented by telco operators. As network technology has advanced and improved over recent years, energy requirements needed to boost signals are reducing. 5G uses 10% of the network energy consumption compared to 4G. That said, with the amount of data traffic that 5G will support, it will require a balancing act for telco operators between trying to meet their sustainability requirements and optimising service and network efficiency.

Market

AI fatigue? One would be forgiven for being exhausted from reading and hearing all things related to AI. Every day we are now seeing so many new products being built that incorporate AI in some form or another and keeping up with it all is a tall order, even for avid techies. OpenAI released an iOS version of ChatGPT, (with an Android version expected soon) that will work directly on an iPhone and with the ability to speak a request for information into its interactive chatbot. Microsoft too are launching Co-Pilot with a range of assistive capabilities that will make our PCs more intuitive and easier to use. Some of you reading this, might well start to notice new functions/icons appearing across the ribbon of word ready to be used. Bing Chat is also being plugged into Windows, bringing the ability to speak to your PC screen and letting the search engine do the work. All of these developments are leading to a proliferation of start-ups building more solutions that could replace tools such as Excel, TikTok or event Co-Pilot and it hasn’t been fully launched yet.

There are even tools that can clone one’s voice; Paul McCartney has confirmed AI has helped resurrect a piece of John Lennon’s voice for a new Beatles song, 40+ years after his death. The song is due to be released later in 2023 and with some vocals from John Lennon previously recorded on an old demo. In summary to add to the fatigue, CB Insights have just published winners of the seventh annual AI 100 a list (chosen out of 9,000), of the 100 most promising private AI companies across the globe. Of those, around a third are focused on applications for specific industries such as textile recycling for fashion or visual dubbing in entertainment. A further 40 are focused on broad industry solutions, such as digital twins, climate-tech and AI assistants.

We are only at the beginning, lots, lots more to come.

Customer intimacy: we have all heard of customer service, then over recent years as customer demands shifted, it became more about customer experience. As we look forward to end of 2023 and into 2024, we are going to see and hear much more about customer intimacy. The term dates back to a Harvard Business Review that suggested those pursuing this type of customer strategy continually adapt and shape, products and services to fit an increasingly “fine” definition of the customer. Despite the concept being around for some time, it is increasingly being quoted by technology companies as part of their customer strategy.

From a digital perspective, it has shifted somewhat and is evolving more towards how relationships can be enhanced through personalisation. With technological advancement and the breadth of choice, in order to differentiate themselves from competition businesses need to connect with customers on a deeper level. The secret to customer intimacy? A data-centric, evidence-based approach to how relationships are created and emotional connections are made. Being human, boosts customer loyalty.

Green transition/reduction in carbon emissions: below we take a look at what each of the key subsectors are/can do to become more sustainable to reduce their carbon footprint.

Technology: Data centres and other large energy users are expected to account for almost 28% of total electricity demand in Ireland by 2031, with further significant growth forecasted. Ireland is host to a significant amount of data centre infrastructure owned by global multi-nationals operating in the technology sector, that support thousands of jobs and is a gateway connecting Ireland and Europe to the East Coast of the United States. Furthermore, as the government have identified data centres as critical infrastructure, both industry, owners of the power grid and government will need to work together to devise a more sustainable approach to the sector in the time ahead.

In the meantime, data centre providers are adopting a range of measures to reduce their carbon footprint and become energy efficient such as sourcing power from renewable sources and operating to high energy-efficiency standards with a view to evolving to a 100% renewable energy model.

Harnessing the potential of technology can play a critical role in building a more sustainable future for the generations to come.

Advancements in AI, Machine Learning, IoT, and data analytics provide the tools and ability to manage and monitor natural resources and promote ethical and sustainable practices to enable businesses and individuals collectively meet the challenges of green transition in the time ahead.

Media: In 2011, Albert was founded, which is a UK-based organisation that initially brought together British screen industries to make a positive environmental impact while also inspiring audiences to act for a sustainable future. Albert has created tools that enable TV/Film productions to understand their environmental impact, such as offices, studios, travel, accommodation locations disposal of materials and postproduction.

In 2019, the Albert carbon calculator was modified for use in Ireland by the Screen Greening coalition that combined all the main broadcasters, agencies and regulators. This has allowed producers to endeavour to reduce emissions by implementing sustainable practices throughout their production, such as, the elimination of single use plastic, smart waste management solutions, and potential reductions in travel. Actors/performers too, have a role to play in championing climate action through their contracts, by encouraging good environmental practices to be observed on set, such as requesting plant-based catering, low energy lighting, or for the production company to agree to a ‘zero to landfill’ policy.

Telecoms: According to Boston Consulting Group the digital sector, powered by telecoms networks and data centres, is forecasted to contribute up to 14% of global carbon emissions by 2040, a significant increase from the current 3-4% level. In a major demonstration of alignment across the industry, 50 operators representing 63% of the industry by revenue and 44% by connections have committed to rapidly cutting their emissions over the next decade. Hence, in order to drive sustainability practices, telcos are now changing focus away from growing revenues and profits to greenhouse gas emissions (GHG) and waste. In Ireland, given energy demands of powering networks, telcos can become more energy efficient across networks by adopting energy-efficient technologies, such as Vodafone Ireland whose network is powered by 100% renewable electricity. Other initiatives that the telco sector can undertake include embracing responsible e-waste management and having plans and policies in place to promote sustainable device recycling to minimise waste and promote the circular economy. Likewise, this sector has broad vendor partnerships and can take a more proactive approach to promoting sustainable supply chain management in regard to sourcing or raw materials and reducing packaging waste.

Funding activity

Over recent months we have supported customers across the various subsectors in their growth ambitions. The trend of consolidation continues across the managed service space and we were delighted to again support businesses continuing on their acquisition trail, bolting on more businesses, adding to their burgeoning suite of technology offerings and broadening their geographical footprint. Digital transformation continues and this is providing a further boost to various technology consulting providers as they help their clients identify the most appropriate technology development roadmaps, nuanced to the how they can engage with their customers in a digital economy.

We continue to support businesses seeking to refinance from alternative lenders with the aim of reducing their cost of capital and look forward to working with other similar businesses through the remainder of the year.