From start-up to scale-up, Sandra Clarke from Xeinadin reveals financial strategies for business growth.

Growing a business from a start-up to a scale-up is an exciting journey, full of opportunities—but for many SMEs in Ireland, it’s also a challenging one. At Xeinadin, we understand the hurdles business owners face. Earlier this year, we surveyed over 500 SMEs across Ireland to gain insights into their growth journeys.

The results were both inspiring and sobering: while 57% of businesses reported revenue growth last year, significant barriers remain. Among the top challenges cited were tax and VAT increases (30%), minimum wage rises (22%), and late payments from customers (21%).

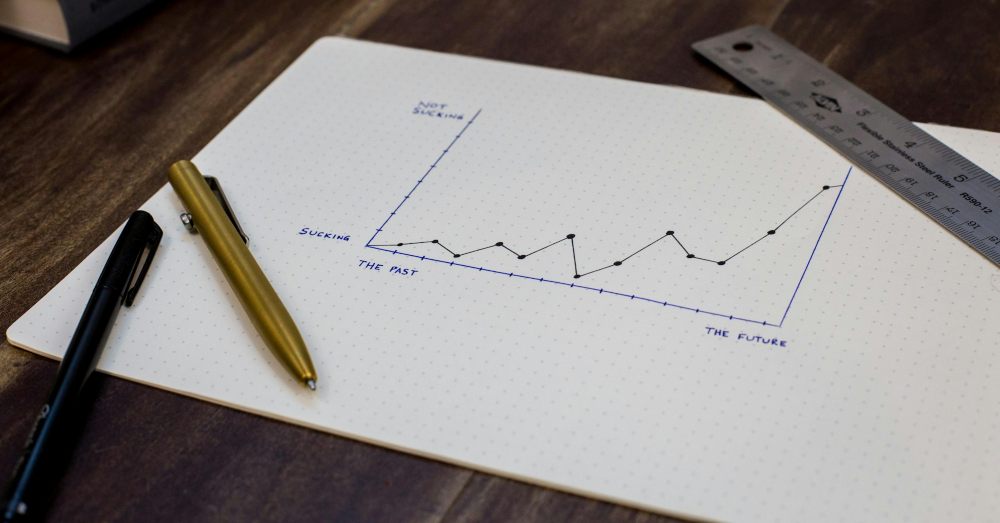

“Scaling up requires deliberate and strategic adjustments to support sustainable growth”

These findings echo the latest All-Ireland Business Monitor by InterTrade Ireland. According to Martin Robinson, InterTrade Ireland’s Director of Strategy, emerging obstacles to growth include “business and consumer confidence, cash flow, access to finance, and demand for goods and services.”

While many growth challenges are external and beyond your control, your financial strategy is not. Scaling up requires deliberate and strategic adjustments to support sustainable growth. At Xeinadin, we’ve outlined a 4-point financial plan to help you transition smoothly and confidently into your next stage of business growth.

-

Strengthen Cash Flow Management

Cash flow is the lifeblood of any scaling business. As your operations grow, so too will your expenses—whether through hiring, increased production, or expanded services. Without a clear cash flow strategy, even the most profitable business can falter.

To strengthen cash flow management:

- Forecast regularly to anticipate financial needs and obligations.

- Plan for scenarios to prepare for potential shifts in the business environment.

- Build a cash contingency fund to handle unexpected costs without compromising your stability.

-

Invest in Scalable Infrastructure

To grow, your business needs systems that can scale with it. Investing in technology, tools, and processes designed for efficiency can reduce manual effort, improve productivity, and keep costs manageable.

Consider:

- Cloud-based software for streamlined operations.

- Automation tools to reduce repetitive tasks.

- Customer Relationship Management (CRM) systems for managing growing customer demands.

Scalable infrastructure supports consistency and efficiency, allowing you to focus on strategic goals rather than day-to-day inefficiencies.

-

Explore Financing Options for Growth

Scaling up often requires capital investment. Finding the right financing options is critical to fueling your growth while maintaining financial health. From business loans to venture capital, each option has unique benefits and implications.

Key considerations:

- Business loans can provide long-term stability but may affect cash flow due to repayments.

- Venture capital offers funding in exchange for equity, which could dilute ownership but may also bring valuable expertise and networks.

-

Monitor Key Financial Metrics

Keeping a close eye on your financial performance is crucial when scaling. Key metrics like gross profit margin, customer acquisition cost (CAC), and customer lifetime value (CLV) provide actionable insights into your business health.

Regularly tracking these metrics allows you to:

- Identify trends and opportunities.

- Spot and address inefficiencies.

- Make informed, data-driven decisions to stay on track.

There’s a way forward

Scaling your business doesn’t have to be overwhelming. Strategic financial planning lays the groundwork for efficient and sustainable growth, helping you overcome barriers and build resilience.

With tailored strategies to strengthen cash flow, invest in infrastructure, explore financing options, and monitor financial health, you can navigate challenges and grow with confidence.

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple