Bank of Ireland sets out four point plan to increase consumer and business protection.

There is a fraud epidemic raking Ireland and consumers and businesses need better protection.

Against a backdrop of a 76% increase in investment fraud this year, Bank of Ireland has today outlined a four point plan to better protect consumers and businesses from fraud.

“Financial crime respects no individual, no company, no Government, and no border”

The plan calls for action in a number of areas where consumers are especially vulnerable to fraud, and where change is urgently required.

Bank of Ireland has written to the Oireachtas Committee on Finance, Public Expenditure and Reform and political parties in Leinster House to set out the four interventions in detail, and to explain how these actions would significantly enhance consumer and business protection from fraud and financial crime.

The Bank has asked political representatives to consider including these four interventions in manifestos that are currently being prepared for the coming General Election.

Crime without borders

“Financial crime respects no individual, no company, no Government, and no border,” said Bank of Ireland CEO Myles O’Grady.

“It constantly evolves to target us in new ways and to steal money, hurting individuals and society as a whole. That is why we are calling for action, setting out four important proposals to help combat this problem.

“To the end of 2025, Bank of Ireland will spend €50m to protect our customers from fraud. This includes resourcing a dedicated fraud team which works 24/7 to catch fraud attempts, and which our customers can call anytime, day or night. We’re also investing in technology, and run an always-on, high-profile consumer awareness programme. Criminals constantly evolve, however, and we all need to work together on this serious problem.”

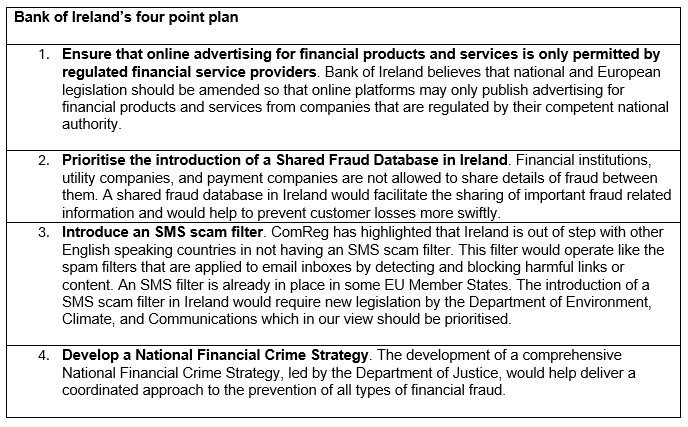

The plan includes restricting online advertising for financial products and services to financial services providers that are regulated, the development of a shared fraud database, the introduction of an SMS scam filter, and for a co-ordinated national financial crime strategy to be put in place.

For consumers and businesses, these actions would better protect them from the wave of fraud attempts they are vulnerable to through text messages, social media ads, and search engine results.

For corporate Ireland and the State, these actions would allow for the rapid sharing of information to track and tackle fraudsters in real time, and for the national response to this fast-evolving and insidious threat to stay one-step-ahead ahead of the criminals.

“We’ve seen a 76% increase in investment fraud attempts in the first half of the year,” said Paul O’Brien from Bank of Ireland’s Security Group.

“On any given day, you can find ads online supposedly fronted by high-profile politicians, business people, and journalists offering huge returns for small investments. They’re fake ads, however, but they’re everywhere and they’re catching people out. Similarly, consumers face a wave of fake texts, each of which is trying to get them to divulge confidential information.

“Ireland has become an outlier on a number of fronts. This is no doubt attracting even more fraudsters to target Irish consumers and we need swifter policy action to combat this. Other countries in Europe and around the world are taking firm steps to interrupt the criminals and protect the consumer, and Ireland needs to follow suit,” O’Brien said.

Main image at top: Baz Ashmawy and Mary Aiken recently launching the new Bank of Ireland fraud campaign with members of the Bank’s Fraud team in the background

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Apple

-

Spotify

-

SoundCloud