In her latest Developments & Insights analysis, Bank of Ireland’s head of Food & Drink Sector Lucy Ryan notes that despite global volatility, Irish producers are adapting.

“Industry has adapted to this volatility sourcing alternative ingredients and raw materials from several suppliers and closer to home, to avoid supply chain delays”

Market insight

It is encouraging to see the Jan-Sep ’24 value of food and drink exports was €12.71bn vs €12.22bn, +4% YoY15. All sub-sectors performed ahead of last year, with dairy the only exception at -3% year-on-year (YoY).

- In terms of destination markets, food and drink exports to GB grew +3% in Jan-Sep, NI +7%, EU +2%, USA +34% with exports to PRC (China) and Rest of World -16% and -2% respectively. PRC has been slower to reopen post-pandemic than other markets.

- Trading Economics reported food inflation of 2.1% in ROI in October, versus September’s 1.9% with EU food inflation 2.6% and the UK 1.9%.

- The doubling of cocoa prices in 2024 – circa USD $8,300 per metric tonne in Nov ‘24 – led to significant price increases in chocolate-based goods, forcing producers to consider alternatives.

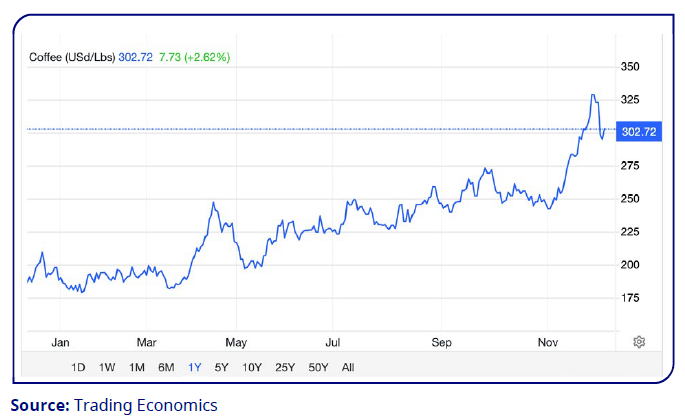

- Coffee prices increased in 2024: Arabica coffee futures were almost USD $3 per pound, a new high since April 2011. Drought in the world’s largest producer Brasil indicates lower harvests.

Geopolitical issues continue to bring uncertainty. However, industry has adapted to this volatility sourcing alternative ingredients and raw materials from several suppliers and closer to home, to avoid supply chain delays, and innovating to reduce reliance on particular ingredients. Despite the many setbacks for producers – high input costs, supply chain blockages and staff shortages, the industry outlook remains buoyant.

When do consumers start buying food for Christmas?

Whilst consumers may complain Christmas ads feature too early, producers and retailers invest year-round efforts in anticipation of the busiest food shopping period. In 2024 in the UK, Kantar data shows that early festive food shopping, with 14% of shoppers buying mince pies in October ‘24, boosted grocery sales by 2.3% in 4 weeks to 3 November ‘24 to £11.6bn, the biggest sales month of 2024.

In the Republic of Ireland, in four weeks to 3 November sales reached €1.16bn, the strongest sales month of 2024 and Dunnes held market lead position. Halloween and early Christmas shopping also increased shopper purchases in ROI with an extra €774k spent on Christmas baking ingredients.

Food inflation

Whilst food inflation moderated from the highs of 2023, and remains in low single digits, food prices continue to grow albeit at a much lower level. Strong cost control remains critical as producers manage high input costs. The FAO Food Price Index (FFPI) averaged 127.4 points in October 2024, up 2% from its revised September level and the highest since April 2023.

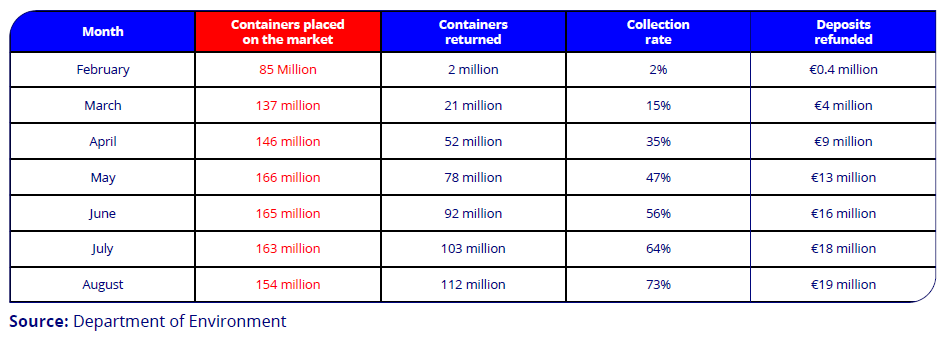

Re-Turn Deposit Return Scheme – return rates low to date

According to Department of Environment figures released, fewer than 1 in every 2 containers or 45% have been returned since the Deposit Return Scheme scheme launch on 1st February. The scheme requires producers to report monthly data, and there can be a time lag for containers to be sold and returned, so it remains to be seen as to the longer term success of this initiative to reduce single-use plastic.

Brexit and Border Target Operating Model (BTOM)

The final element of BTOM, a set of measures introduced to help manage imports into Britain after the UK’s departure from the EU, has been delayed from late 2024 and will not now be implemented until 2025. This requires traders to submit safety and security declarations for all imports into GB. Whilst BTOM requirements can be administratively onerous for exporters, the importance of the UK as the largest market for food and beverage exports, means traders have invested in managing the new requirements.

Has online grocery shopping changed food purchasing patterns?

With the growth of food sales online in the pandemic, many assumed this trend would continue. Producers found ecommerce solutions and online shops to supply directly to consumers (“DTC”).

Whilst online food shopping has a loyal base, many shoppers prefer in-store shopping and online levels remain low. Recent Kantar data 12 weeks to 29 Sep ‘24 shows online grocery shopping of 6% value & pack share. By comparison, in the UK online grocery sales account for circa 12% of the total.

Some small producers continue to favour DTC as it can be more cost-effective and enables the gathering of sales data and trends. Subscription models can help operators establish a loyal consumer base with digital activity effective at targeting consumers. Nonetheless, as online food sales remain relatively low in ROI, producers also need retailer listings to access 90+% of shoppers.

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple