In his latest Development & Insight, Bank of Ireland’s head of Hospitality Sector Gerardo Larios Rizo reveals new patterns that have emerged in the sector.

As we close the chapter on 2024, businesses are strategising or the year ahead and what this might mean in terms of consumer demand, staffing, inflation and ultimately their bottom line.

Consumer sentiment (Trading Economics) has been steadily increasing this year from 62.4 last December to 74.1 at the end of October, unemployment levels remain stable at around 4.2% (CSO) and inbound visitor trips for the first nine months of 2024 are up 10% on last year (CSO).

“Shorter and more frequent holidays have become the new normal after a temporary disruption of travel patterns during the Covid pandemic”

Bank of Ireland’s latest economic outlook for Ireland 2024/2025 points out that “with inflation falling back and real incomes growing, consumer spending should continue to expand.”

There are of course challenges ahead particularly about the wider sociopolitical environment in Ireland and abroad but the outlook for the sector in Ireland remains positive at this point in time.

Less is more

Shorter and more frequent holidays have become the new normal after a temporary disruption of travel patterns during the Covid pandemic. Stats available from the CSO for domestic trips by Irish residents for the first half of 2024 show an average of just 2 nights per trip vs 2.2 nights for the same period in 2019 and 2.4 nights back in 2014.

A similar trend is reported for outbound travel by domestic residents where trips have decreased from an average of 7.2 days back in the 6 months to June 2014 to 6.5 in for the same period in 2019 and just 5.7 for 2024. Average spend per trip had slightly softened before 2019 but surged over the last four years shaped by the inflationary environment.

Inbound travel stats from the CSO for Jan to Sept 2024 vs same period for 2023 show a 9% decrease in average stay from GB (England, Scotland & Wales) visitors, and an 18% decrease for “Other Europe” while US average trip duration remains unchanged.

Discounted pricing for extended stay/additional nights, flexibility on late checkouts/early check ins, and package deals have long been a feature of hotels as they try to maximise stay and ancillary revenues. Enhanced public areas and investment in additional facilities (leisure) are currently being considered by a number of operators.

Margin watch

The hospitality sector has been dealing with an escalating cost base over the last couple of years as inflation impacted on cost of food, drink, labour, and energy in particular.

#As we look into 2025, the minimum wage is set to grow by 6% up to €13.5011, sick pay leave entitlement will increase by 2 days12 in 2025 (going up from 5 to 7) and pension auto-enrolment is due to commence at the end of September.

Inflation has slowed down as evidenced by the CSO’s Consumer Price Index for October showing an increase of only 0.7% for the last twelve months, going forward, price increases may face increased resistance from consumers across accommodation, food, and drink sales. Businesses have embraced dynamic menu engineering, become much more aware of food wastage and we have seen an increasing number of operators reviewing their purchasing practices and or purchasing platforms.

The traditional 70% GP Margin target for food and drink sales has been forced upwards in the last couple of years as operators look to compensate for higher labour, energy, and insurance costs.

Foodservices sector

Bord Bia has recently released their annual Market Insights Report 202413. The report which focuses on the foodservices sector across the island of Ireland shows a preliminary growth estimate of 5.2% for the current year. The report also highlights a number of trends visible across the various sub-sectors it examines, including:

- Price increases and impact on footfall in the sector during2024.

- The opportunity in the demand for “experiences”.

- Digital investment to address challenges.

- Growth of chains at expense of independents.

- Restaurant visits becoming more planned and less spontaneous.

Also noted in the report is the fact that the recovery of the different subsectors has not been even over the last couple of years, “limited-service restaurants appear to be taking the lead while “hotel and accommodation” providers have on average experienced a softer post pandemic recovery path.

Hotel accommodation sales

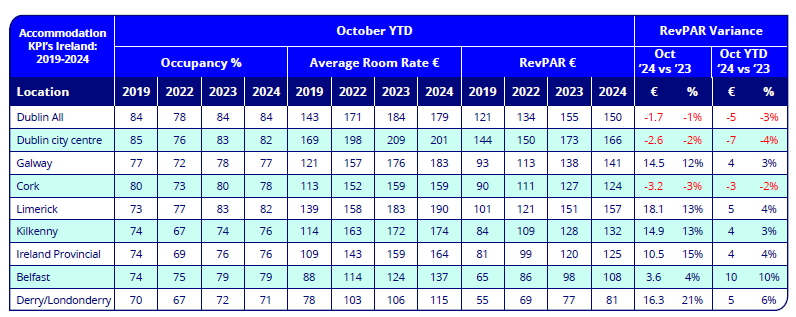

Accommodation sales statistics have been on a largely positive trend for most locations across Ireland (CoStar).

Occupancy has remained strong whilst average rate grew across all locations except Dublin and Cork where new accommodation supply diluted some of the demand.

The Dublin Region has clawed back on the “RevPAR” (Revenue per average room) gap against last year that stood at -5% last June, now at -3% to the end of October. New economy class accommodation supply coming into the market in 2025 may continue to impact on average rate growth over the next 12 months. Galway city has reported slightly softer demand to date but this has been compensated by a 4% increase in rate to the end of October.

The opening of 177 rooms at the Radisson Red in Crown Square will likely impact occupancy rate prospects for the year ahead as it will increase the bedroom stock for Galway city by around 6%. Cork city occupancy and average room rate to date, reflect the increase in bedroom stock so far this year. Limerick continues to take the lead within ROI with a 4% increase in RevPAR delivered on the back of a €7 increase in average room rate.

RevPAR to the end of October is only second to Dublin city centre. Belfast remains in the top position within the island of Ireland when it comes to improved performance against last year with RevPAR growth of 10%.

Main image at top: Photo by Meg Jenson on Unsplash

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple