Hotels have reported encouraging accommodation sales, but the landscape has been a little less benevolent for food and drink services, notes Gerardo Larios Rizo, head of Hospitality Sector at Bank of Ireland in his latest H1 Insight, H2 Outlook 2024 report

“Profit margins have come under pressure for the sector due to a convergence of factors including the hospitality VAT, wage increases and escalating sick pay entitlements, among others”

2024 H1 Insights

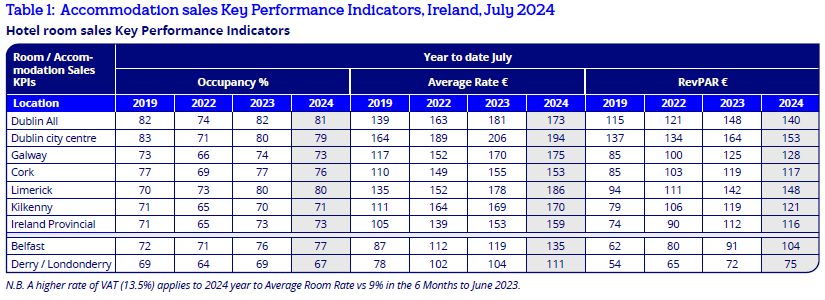

After a slow start to the year, demand for tourism accommodation has picked up in recent months. All markets reported by STR outside Dublin, are now reporting Revenue Per Available Room (RevPAR) figures in line or ahead of same time last year to the end of July.

Dublin continues to lag slightly behind last year due to a material increase in hotel bedroom supply within the “economy” segment which has impacted both rate and occupancy figures to date.

Belfast has reported the strongest year on year improvement with a 13.6% increase in RevPAR at the end of July 2024. A total of 25k Fáilte Ireland registered bedrooms remained under government contract in ROI at the end of May (Failte Ireland) this year. The number is materially down (8.5%) on the figures reported November last year.

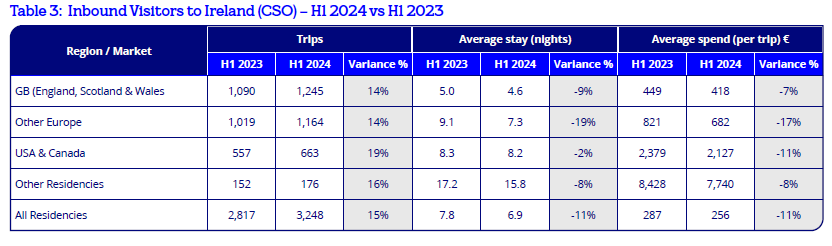

Stats available from the CSO to the end of June show a 15% increase in inbound trips for the 6 months of 2024 vs. last year, and a 22% increase in expenditure for the same period. Irish Domestic demand statistics for Q1 show an 11% increase on trips vs same time last year but only 10% increase in expenditure.

Profit margins have come under pressure for the sector due to a convergence of factors including the hospitality VAT, wage increases and escalating sick pay entitlements, among others. Pressure is more visible in the food and beverage services sectors where margins are traditionally lower as demand is fast to react when “value for money” becomes an issue.

Accommodation Statistics

The cancellation of over six hundred Aer Lingus flights (BBC) during their pilot’s industrial action negatively impacted on demand in June and July this year (The Irish Times). Tourism accommodation providers have on average (when including Dublin), reported a marginal softening in demand for the first seven months of this year. Demand trends have been patchy; Kilkenny and Belfast are marginally up on last year while Dublin, Galway and Cork are trailing behind. The end of the discounted rate of VAT has put additional pressure on profit margins but average room rates are holding up strongly despite the impact of the 4.5% increase in hospitality VAT.

- Dublin All (STR): A soft July impacted YTD totals after strong performance reported for the month of June. July 2024 Year to Date (YTD) RevPAR is 5% down on last year (Occupancy 1% down and Average rate 4% down). Hotel bedroom supply in the Dublin region increased by an estimated 7.7% between July 2023 and July 2024 (STR).

- Dublin City centre: July 2024 YTD RevPAR is 6.8% down on last year (Occupancy 1% down and Average rate 5.8% down) – Average room rate rose to €248 for the month of June in the city centre driven by a number of events. “Hotel performance peaked on Saturday June 29th (supported by Swifties) with occupancy at 95.5%, ADR of EUR305.30 and revenue per available room (RevPAR) of EUR291.59. (STR)

- Galway: July 2024 YTD occupancy remains down on last year (1% below 2023), however average room rate growth of €5 (3%) has compensated for this bringing the RevPAR up 2% YOY.

- Cork: Reported occupancy and rate fell behind fell behind last year for June and July 2024. YTD RevPAR is marginally behind last year (2%) with softer average occupancy and rate for the period. Hotel bedroom supply in Cork city increased by 187rooms (8.8%) (Failte Ireland this year with the opening of the Premier Inn in Morrison’s Quay.

- Limerick continues to lead the table on RevPAR growth within ROI. July YTD Occupancy is in line with last year, however average rate is up €8.3 (5%) for the same period. N.B. 25% of Failte Ireland registered accommodation in neighboring Clare and 7% in Limerick currently under Government contract

- Belfast has maintained its spot in the RevPAR leader table for in the Island of Ireland with a 13.6% Year on Year RevPAR Increase at the end of July 2024.

- Derry: Slight slowdown in occupancy for the first half of the year compensated by strong average room rate of €111 (7% up on last year).

Transaction Activity

- The strong financial performance reported by the hospitality sector in Ireland during 2023 has propelled hotel transaction activity so far this year. Investors have focused on the sector as it continues to lead performance across commercial real estate. Hotels, particularly in Dublin, remain an attractive asset class and so international buyers and funders have dominated the landscape to date.

- JLL Estimates a total of €816m of hotel assets have already transacted in ROI this year, encompassing a total of 1,579 hotel bedrooms. Average price per key for the year €517k has been skewed by the Shelbourne (€260m) ( and Press Up Group (€355m) (The Irish Times) transactions. If these are taken out the price per key drops to €368k. JLL estimates there are an additional €500m worth of active transactions in the pipeline, some of which could be completed this year.

- In Northern Ireland, the market has also been active, notable sales reported this year include Etap, Holiday Inn Express Antrim, The Lodge Hotel, The Londonderry Arms and The Park Inn. “The market remains very hot and is being buoyed up by the prohibitive cost of construction and protracted process of planning” (Northern Irish Hotels Federation). The Armagh City, The Roe Park Resort and The Rosspark hotels are currently up for sale.

- Moderately strong transaction activity also reported in the licensed trade with well-established pubs transacting in Dublin including McSorley’s in Ranelagh for an estimated €5.5m, and Foley’s Pub in Baggot Street for €7m (Lovin Dublin); in Cork Reardon’s and Oliver Plunkett are being acquired by Attestor Capital (Irish Examiner). In the restaurant space London investment firm Cheyne is anticipated to take a majority stake in the Press Up Hospitality Group (Irish Independent) which owns restaurants such as Captain America’s, Elephant and Caste and Angelina’s, among others.

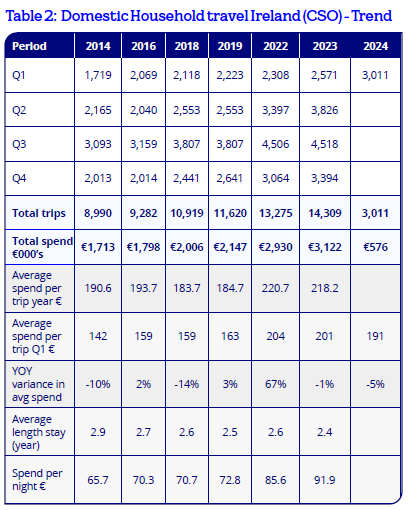

Demand

- Low levels of unemployment in Ireland (4.7% at the end of July 2024 reported by the CSO continue to support healthy levels of discretionary spend from the domestic market. Household Travel survey reports (CSO) for year-end December 2023 showed an increase of 8% in trips from the domestic market and a very marginal decline in average spend (1% down) against the same period in 2022. Stats released for Q1 this year show the trend continues with a 10% increase in trips and a more pronounced drop in average spend (5%). Operators across the country have been reporting this trend, highlighting shorter stays and a softening in ancillary spend.

- Encouraging trends in the number of overseas visitors’ trips. Ireland reported a 15% increase in the number of overseas visitor trips for the first half of 2024 (CSO) vs same period last year. However, the average length of stay (based on the room nights delivered), reduced from an average of 7.8 last year to 6.9 this year, meaning trips are getting shorter. As a result of this (and similar to the trend with the domestic market) the average spend per trip also took a tumble of 11% for comparable periods in 2023 and 2024.

Hotel Development

- Positive average room rates for hotels in Dublin continue to support a healthy development pipeline of around 10,000 hotel rooms of which about 30% are under development (STR); regionally new properties are opening in Cork and Galway but only a limited number of bedroom extensions expected elsewhere because of escalating development costs.

- Tightening of margins in food and drink sales could support development of additional bedroom stock in well-established operations; the business case for investment could prove more appealing for those looking to improve on profit margins.

Government Contracts

- A total of 77,315 beds are presently under government contract for humanitarian purposes, a fall of 8.5% since November 2023.

- An estimated 32.4% of these beds (25,079) are in premises on Fáilte Ireland registers (hotels, B&Bs, Guesthouses), 10% of all registered tourism bed stock is under contract. County Clare, at 25% is the only county with more than 20% of registered bed capacity out of use for tourism. Meath, Louth, Mayo, and Wicklow all have 15-19% of registered stock under contract. The Taoiseach recently confirmed that about seventy refugee accommodation contracts (RTE) will expire “shortly,” and properties could return to public use.

Trends

- Industry groups continue to lobby for the restoration of the lower rate of VAT for Hospitality sales (Food and Accommodation). The increase which came in to effect last September, is said to be main driving factor behind a number of restaurant closures. According to a recent report from the Restaurant Association of Ireland (RAI), the closure of one restaurant results in the loss of twenty two direct jobs on average. The RAI estimates an average of two restaurants, cafes and other food-led businesses are closing their doors each day.

- Price inflation in Hotels and Restaurants in the 12 months to July 2024 is running at 4.3%, well ahead of the 2.2% average for all items reported by the CSO for the period. (CSO)

- Passenger cap at Dublin airport remains a major concern for stakeholders across the sector as the 32m cap could already be breached this year. A number of airlines including Air Canada and Etihad have already failed to secure all take-off and landing slots they requested for winter. (Failte Ireland)

- Brands continue to strengthen their presence in the Irish market. Marriot, IHG, Ruby, Premier Inn and Radisson all expected to add new properties to their ROI portfolios this year.

- Challenging start of the year for businesses across the sector. Fáilte Ireland’s latest tourism barometer (May 2024) indicated that 44% of sampled businesses had experienced a decrease in visitor numbers. The drop is more pronounced in the food and drink space where 55% reported weaker trade. The slight slowdown in demand could be linked to combination of factors, including lower disposable income, higher prices implemented across hotels, bars and restaurants, and lack of tourist accommodation in some areas as well as the prolonged poor weather impacting domestic demand.

- Increased cost pressures are challenging businesses to review their operations as they look to implement efficiencies to protect the bottom line. Operational reviews are driving an appetite for refurbishments, repurposing of facilities like unused meeting rooms and nightclubs, and the development of additional bedroom stock.

- Slowdown in average spend reported for both domestic and overseas visitors. The trend was already emerging last year and has been associated with the unwinding of the increased savings accumulated during the pandemic, but the gap has grown marginally larger. Average spends per domestic trip for ROI residents for Q1 this year is down 6.4% on the peak reported for Q1 2022.

Tax debt Warehousing

- Almost 90% of the €1.65 billion debt that remained in the warehouse at the start of April 2024 was now either paid in full, secured under phased payment arrangements or included within a proposed phased payment arrangement which is in the process of being finalised. (Revenue.ie)

- 1,820 businesses are in the Accommodation & Food Services Sector, with a total outstanding balance of €180m are in a phase payment arrangement (PPA). (Failte Ireland)

- A total of 762 businesses in the Accommodation & Food Services sector with a combined outstanding debt of just under €13.5m did not engage with Revenue by the May 2024 closing date.

ESG

- Businesses in the hospitality sector continue to explore options to improve on their green credentials. Enquiries about support for “green” investments including heat pumps, solar panels and other equipment upgrades are on the rise.

- Whitbread hotels (Premier Inn) have been pushing for their buildings to be as green as possible, while also looking at their biodiversity metrics. Matt Gent from Whitbread confirmed that the last hotel to open in Cork is rated as BREEAM Very Good (A2), and the group’s pipeline in Dublin and regionally is all rated under BREEAM Excellent and expected to be 100% electric powered by the time they open.

- The JMK Group has been focusing on their green credentials for some time. JMK indicated their next two openings: 1) Cork (Moxy & Residence Inn, 194 bedrooms) and 2) Belfast (Aloft & Residence Inn, 228 bedrooms) will both boast BREEAM “Excellent” and Leadership in Energy and Environmental Design (LEED) “Gold” credentials.

Sector Outlook

Premises that cease to accommodate refugees over the coming months will require varying levels of refurbishment before they can return to provide accommodation for the tourism market.

Further planned increases to minimum wage, a further ramp up in paid sick leave and the introduction of auto-enrolment could compromise the viability of some businesses in the foodservices sector in the coming year.

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Apple

-

Spotify

-

SoundCloud