Ireland’s Grocery/Convenience sector continues to perform strongly, says Bank of Ireland head of Retail Sector Owen Clifford.

“Retailers are navigating a turbulent economic environment linked to inflation, access to personnel and fluctuating consumer sentiment”

Retail Convenience: H1 2024 Review

Summary:

- Robust performance: Robust performance delivered by the sector in H1 2024. A shift in consumer behaviour to increased frequency patterns coupled with increased engagement with own-brand ranges.

- Inflation: A stabilisation of price inflation for consumers – operators continue to address cost/overhead profile proactively.

- Consolidation: Increased consolidation has become a feature of the market with larger grocery/fuel operators expanding their store network and diversifying their sales mix.

H1 2024 Key Trends:

- Strong growth in take-home grocery sales continued. Irish grocery inflation stood at 2.8% in July / August 2024 representing a normalisation of food prices in the market. The large supermarket operators have been proactive in addressing cost of living concerns with targeted ad campaigns and voucher offers being strongly promoted in recent weeks. As consumers seek cheaper alternatives across some product lines, all leading operators recognise that a strong own-brand offering is now critical to maintain customer engagement. Own-brand product sales increased by c4% compared to 2023 with the expansion of “Premium” / higher quality own-brand ranges delivering growth of c10%. (Kantar)

- Dunnes and Tesco continue to vie for the number 1 position in respect of grocery market share. This has been driven by a particularly strong performance by Dunnes in the wider Dublin region whilst Tesco’s increased market share reflects Joyce group integration/increased level of new store openings in recent times.

- The large supermarket operators have been proactive in addressing cost of living concerns with targeted ad campaigns and voucher offers being strongly promoted.

- Margin growth and preservation have become an imperative for retailers linked to an increased cost framework driven by personnel, insurance and energy overheads.

Key Activity in the Sector in H1 2024

- Shopping patterns reflected cost of living concerns with increased frequency (shopping little & often) becoming a feature of the market. As expected, food inflation, linked to a significant decline in international food commodity prices in recent months retracted significantly in 2024. As many food/drink manufacturers absorbed increased costs in 2023 to remain price competitive – it is expected that robust price negotiations will remain a feature of the market in 2024. Balancing consumer and supplier relationships will be key in this respect. (Kantar)

- Retailers are continuing to implement pragmatic succession planning structures to ensure that appropriate long-term value is delivered from their business. COVID-19 has been a catalyst for some retailers to investigate future options in respect of both ownership and operational models.

Recent studies across Europe have demonstrated that saving money on food remains a top priority across all income groups. This has led to increased engagement with own brand products and a discernible improvement in own-brand range / options across the sector. The proactive delivery of premium, healthy and sustainable products across the own-brand range will be required to meet customer expectations and preserve retailer margins. (McKinsey)

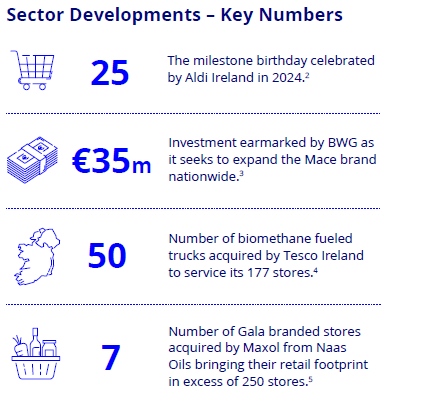

Sector Developments: Investment & Economic

- A significant level of new store openings/extensive store revamps has occurred in 2024 to date across all regions supporting job creation and the wider Irish business ecosystem. This reflects both the competitive nature, robust financial health and positive outlook of the leading brands in respect of the Irish market.

- The increased cost and regulatory burden presented by the proposed living wage structure, pension autoenrollment and insurance in a competitive environment has led to an up weighted focus on margin development/preservation from retailers, wholesalers, and their advisors. Recruitment and retention of personnel in a “full employment” environment continues to be a key challenge for the sector.

- Consolidation and cross-sectoral partnerships remain a feature of the wider Irish grocery / convenience / forecourt market. Tesco integrating nine Joyce group stores within their network, Maxol trialing Dunnes Stores products instore and Circle K purchasing nine forecourt convenience stores from Pelco just a flavour of transactions/activity in the market. Individual store sale activity increased significantly linked to succession planning, landlord deleveraging and independent retailers expanding their store portfolios.

- The de-carbonisation of end-to-end operations remains a key focus for leading operators linked to supplier, Government and consumer expectations/requirements. Multi-million-euro investments linked to improving energy efficiency profile across the fleet, logistics and store network has been a feature of sector announcements / strategies in 2024. The requirements of International suppliers seeking to reduce their scope 3 emission profile under new Corporate Sustainability Reporting Directive (“CSRD”) legislation will continue to act as a driver / incentive in the green transition of the Irish grocery / convenience sector.

H2 2024 Retail Convenience Outlook

- Robust Outlook: Overall a resilient sector to economic shocks; Strong sales performance to continue but increased focus on margin preservation and cost management required to maintain profitability levels/leeway for investment.

- Funding Activity: Strong active pipeline of store purchase and associated revamp proposals– retailers recognise that customer experience/excellent standards will be key to attract and retain market share.

- ESG Investment: Increased investment in environmentally focused store network, waste management, circular operational framework and fleet fuel consumption to support targeted reduction in carbon emissions from the sector.

Market

- In a competitive labour market – sourcing and retaining the best people is vital to sustain a retail business. A structured employee development plan that incorporates role variety, up-skill opportunities and competitive remuneration needs to be embedded within the culture of the business. The smart use of digital/automation tools can deliver the dual goal of increased efficiency and an improved working environment. Retailers familiarising themselves with generative artificial intelligence (“AI”) capabilities in this regard.

- Linked to the development of all personnel within the sector, The Irish chapter of LEAD has been established with the goal of attracting, retaining and advancing women in the retail and consumer goods industry through education, leadership and allyship.

- Significant revamp programme will continue to be rolled out in 2024 nationwide by leading grocery operators as the ever more discerning consumer seeks excellence in store standards. Movement on revamp costs linked to fluctuating material supply base to be monitored closely. Detailed analysis pre and post revamp will be an imperative to ensure that a maximum return on investment is delivered via sales mix improvement, margin growth and cost saving.

- As consumers seek cheaper alternatives across some product lines, all leading operators recognise that a strong, diversified own-brand offering will be critical to maintain customer engagement as the inflationary cycle continues. However, Own-brand is not all about price/value – the development of premium, proprietary in-house food solutions can provide a strong margin-generating differentiation point for retailers when delivered effectively.

- In Ireland, the number of people aged over 65 has doubled in the last twenty years from c400k to c800k in 2023 equating to c15% of the population (CSO). This statistic is expected to rise towards c1.5 million by 2050. At a European level, the “silver economy” is set to represent more than 35% of spending consumption by 2030. Given this exponential growth, meeting the needs of our senior shoppers should be a key focus area for all Irish retailers.

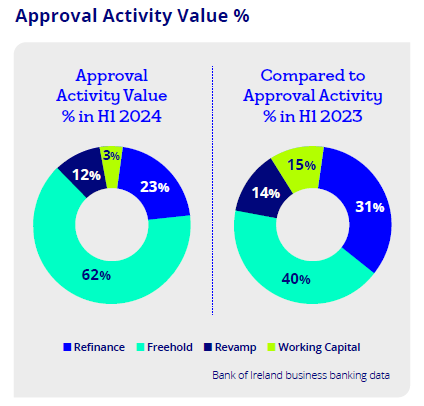

Funding Activity

- Store purchase strategies will continue to develop in H2 2024. COVID-19 has been the catalyst for increased levels of succession planning/retirement which is driving this activity.

- Revamp funding to continue with a particular focus on energy efficient equipment and processes.

- Robust refinance activity projected linked to loan book purchasers seeking to deleverage

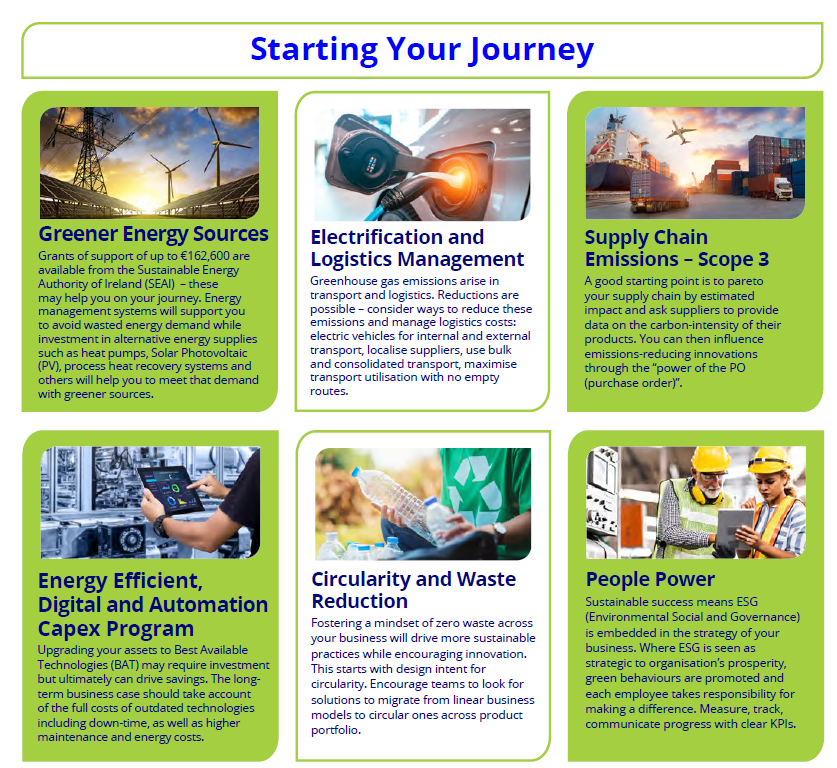

ESG

- Irish retailers are cognisant that a robust strategy for the de-carbonisation of their business model is required to meet Government, investor and consumer expectations/ requirements into the future. Corporate social responsibility linked to sustainable and environmentally friendly in-store activities will therefore be a key area of focus for all retailers – energy efficient equipment, elimination of single-use plastic, improved recycling facilities and reduction of food waste. This will enable an improved cost base whilst meeting consumer expectations in respect of ethical trading.

- Whilst feedback on the Irish deposit return scheme (launched on 1st February 2024) was initially mixed – engagement from consumers has improved month on month. Average daily returns in excess of 3 million were achieved in July resulting in c350 million units being processed in the first six months of the scheme. (Re-turn)

- Studies have identified that c90% of all emissions related to Retail are Scope 3 – linked to suppliers/consumers as opposed to direct emissions from the business itself/ purchased energy (Scope 1 and 2). To move the dial on Scope 3, retailers are starting to establish joint initiatives and incentivisation plans with their suppliers to support improved emission targets and the sharing of related data. In respect of consumer engagement – apps/tools that support customers to set and monitor climate targets for their shopping baskets are also on the horizon. Further information and links to resources are provided in our Short Guide to Sustainability below:

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Apple

-

Spotify

-

SoundCloud