The majority of Irish businesses do not yet have an AI strategy notes Bank of Ireland’s head of Tech, Media and Telecoms Sector Paul Swift in his H2 Outlook for 2024.

“While all things relating to AI continue to dominate technological discourse, business leaders remain cautious about investment in the technology. Maybe now is the time for those creating the technology to place more focus on demystifying its capability and derisking its benefits for businesses”

TMT H1 2024 review

Technology

Data from EY Ireland’s recently published Tech Leader’s Outlook for 2024 made for interesting reading. Despite the high level of interest in AI among those surveyed, more than six in ten (62%) are not yet investing in AI technologies and do not have an AI strategy. Ireland’s tech leaders have instead focused on ensuring their digital infrastructure and core technology is operating seamlessly.

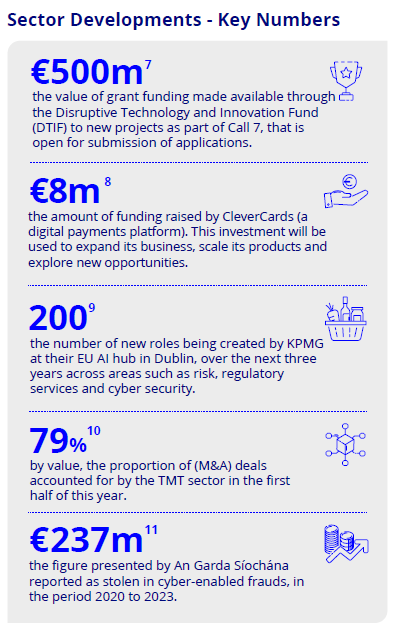

The cautious approach by AI leaders may be a bellwether for the adoption of the technology at large. The recent volatility in tech stocks that saw an estimated combined loss in value of c€1.3 trillion (CNN Business) among the ‘magnificent seven’ (Nvidia, Apple, Amazon, Meta, Microsoft, Alphabet and Tesla) among other reasons, is said to have been caused by concerns about profitability around investment in AI by ‘big tech’. Despite the extraordinary investment made in the technology, investors had become wary as to when they will see a return in the bottom line.

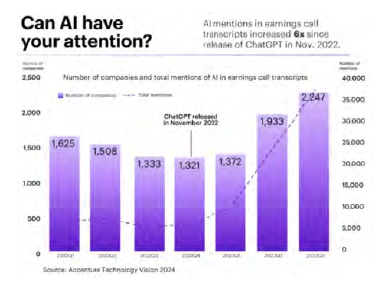

Accenture published their Technology Vison report earlier this year which highlighted that AI mentions in earnings call transcripts has rocketed since the launch of ChatGPT in November 2022. This says more about companies ‘jumping on the AI bandwagon’ in exaggerating their progress, than necessarily having concrete propositions to bring to the market. Those companies building transformational AI need to do more to educate their customers to help them be less cautious about investing in the technology. Maybe then, their investors will see a return. Time will tell.

Media

Bank of Ireland was delighted to partner with Animation Dingle earlier in its 12th year, to support all that is great about Ireland’s animation industry. Over three days executives from global streaming channels, broadcasters and heads of studios descended on Dingle in what is a unique festival. In bringing together industry and students, it serves as an excellent platform to harness a pipeline of talent to support the growth of the industry here in the years to come.

Telecoms

The first half of the year saw Viatel continue on its growth journey with MJ Flood Technology being the group’s ninth acquisition since 2020. This latest acquisition augments Viatel’s leadership position in cybersecurity, cloud technology and communications. It has been a busy several years for the group, to say the least. They have moved from a traditional telecoms provider, in a deeply commoditised sector, to become a more broad-based cybersecurity, connectivity and digital services business. Over recent months Vodafone have been following a similar strategy as they too, have expanded their offering to include Microsoft 365, cloud services, data analytics tools and cyber security. Both companies are capitalising on their core offering of internet connectivity and augmenting their offering by providing additional services, competing with traditional managed services providers, paving the way for further consolidation in the sector.

2024 H1 Key Sector Trends

Cloud adoption soars: the number of Irish companies hosting all of their corporate systems in the cloud has more than doubled to 32% (EY Ireland) up from 15% in 2023. While those that continue to retain their systems on premises and only use cloud for hosting of less sensitive data has fallen to 17%. These results demonstrate that businesses have come to trust cloud technology and the flexibility and scalability it offers when compared to legacy systems. The pandemic gave rise to usage of a proliferation of different cloud technologies as companies grappled to stay connected and in business and the growth in cloud storage demonstrates the maturity and confidence businesses now have in this type of infrastructure.

Investment in cyber security protection: Four out of five senior executives surveyed as part of PWC’s Digital Trust Insight Survey 2024 said they planned to increase their cyber budget to meet their needs and secure their digital platforms, while also making provision to manage the integration of disruptive technologies this year. This dovetails with feedback received over recent months, with many of our customers operating and servicing the cybersecurity sector, reporting significant growth in demand for their services and technology. This demand can be explained from two perspectives, firstly, with the proliferation of cyber threats, companies must now have robust security posture in place to defend against potential breaches.

Secondly, with NIS25 (EU-wide legislation on cybersecurity) on the horizon, which takes effect from October 18th next, along with regulatory compliance demands, are providing the catalyst for businesses to increase their investment in cybersecurity.

Tech talent continues to be a challenge: the trend of recent years continues as companies of every size in the sector face challenges with trying to hire skilled talent. Recent research from ManpowerGroup suggests as much as 81% (Manpower Group) of Irish companies are finding attracting talent difficult. As one would expect, the more specialised and skilled the role, so too are the associated challenges of finding candidates to fill those roles. Those that are open to a move obviously have higher expectations around salary, bonuses, benefits and conditions, further adding to wage inflation. Restrictions in the mobility of talent is compounded by the housing crisis as the potential to hire talent externally is also curtailed. Ireland continues to be an attractive location for candidates outside the EU, but with the added complexity of requiring a work permit on top of finding accommodation adds to hiring challenges for employers.

Key activity in the Sector:

M&A

The trend of recent years continues, as the TMT sector leads the way in terms of performance in Ireland’s M&A market, according to William Fry’s latest, M&A Half Year Review12. Seven of the 20 largest transactions so far this year have taken place in this sector, including the top two. TMT sector was also the highest in terms of volume of deals at 28%, albeit down from 32% for the same period last year. What’s interesting about the types of deals being done, is how they demonstrate interdependencies in the TMT sector and the cross over into industry related infrastructure deals. These include Phoenix Towers International’s acquisition of Cellnex Irish mobile masts business and Blackstone’s acquisition of Winthrop Technologies to acquire digital infrastructure. Also noteworthy during the period saw the Swedish private equity firm, EQT acquire Keyword Studios for €2.6 billion.

Recent Venture Capital investment in the sector

Venture Capital funding continues to show some worrying signs. The IVCA recently published results for the first half of the year which shows overall funding fell by almost a quarter (22%) on the same period last year to €752.7m. Yet, interestingly funding in the second quarter was the second highest on record at €494m, up 7% on the same period last year. Crucially this latest report shows that funding for those businesses looking to raise in the €5-€10m range fell by 44% on the same period last year.

Most of the deals in the €10m+ range, which performed well in the last quarter, 90% of the funding came from international investors, which continues to demonstrate how reliant those businesses are on external investors. Seed funding held up well in the quarter which can be seen from the activity of Delta Partners.

Delta Partners Investments H1 2024

Delta Partners continue to invest in Ireland’s scaling technology sector and have been busy during the first half of the year, as they continue to invest in seed and early-stage start-ups. Bank of Ireland and Enterprise Ireland are cornerstone investors in this fund along with Fexco and several family offices.

Investments during H1 include:

- ZeroMission: the Clonmel based leading provider of an EV fleet management platform for commercial electric vehicles (EVs), secured $3m investment to continue its growth and expansion strategy. The round was led by Delta Partners and Greencode Ventures.

- STRATxAI: the Dublin based Fintech, successfully raised €1.5m and officially launched ‘Alana’ a powerful investment platform that leverages AI to generate smart investment portfolios. The product is already active with investment industry partners including eToro.

- Jamango: the Dublin based developers of a browser-based game creation platform raised $2.5 million to accelerate development ahead of launching globally later this year. The preseed funding round was co-led by Delta Partners and Elkstone with additional funding from notable angel investors including Brian Caulfield (Chair of Scale Ireland), Brendan O’Driscoll (VP of Product at Figma), and Conor Sheahan (Founder of CKS Finance) who joins as Chair.

- Inspeq AI: the Dublin based AI company raised $1.1m in funding. They are on a mission to help global companies deliver a safe, secure, and responsible AI Future. Specialist AI investment firm Sure Valley Ventures lead the funding round, with participation from Delta Partners.

- MarketSizer: the Dublin based market intelligence platform that helps SaaS vendors to grow their business with insights on the commercial activity of their competitors, closed preseed funding round, totalling €1m. The round was led by Delta Partners with additional support from Enterprise Ireland and angel investors.

“We are finally seeing cloud technology becoming ubiquitous, almost three decades since the term was first invented. This will inevitably contribute to further growth opportunities for cloud, data and SaaS providers over the remainder of this year, through 2025”

TMT 2024 Outlook

Technology

Despite recent macro challenges the sector remains resilient, benefitting from the expansion of digitisation and digitalisation of every sector. As more businesses expand their digital footprint through the adoption of technology platforms and tools, many of our customers that are managed service providers will inevitably maximise these opportunities. As already alluded to, cloud service and storage providers will continue to see growth over the remainder of the year through 2025. Further education of the market in how to integrate AI more easily is needed, do de-risk the investment, for businesses.

In this regard, the European Digital Innovation Hubs have a role to play. They are not for profit and have a mission to help businesses better understand where AI can empower organisations.

Media

Looking ahead at the live action/creative space, it will be interesting to see how the government react to the UK increasing tax incentives to 40% net tax relief (up from 25%) for independent feature films. This new legislation announced in March 2024 was enacted before the UK general election. This presents a significant advantage on the UK production sector and will be interesting to see, what, if any, changes are made in Budget 2025 to safeguard Ireland’s growing film production sector.

Telecoms

Ireland’s traditional telecoms sector continues to mature with the mobile market continuing to be dominated by Vodafone Ireland and 3 Ireland, followed by Eir. Smaller, Mobile Virtual Network Operators (MVNO) such as Tesco and Virgin Mobile make up the majority of the remainder of the market. With such saturation and limited growth opportunities it is inevitable these players will seek to expand their services offerings, similar to that of Vodafone, referred to earlier in terms of providing digital add-on services. We are likely to see a continued drive to expand subscriptions on 5G networks that will include Machine-to-Machine (vehicle telemetry, asset tracking etc.) and ramping of Internet of Things connectivity to increase the breadth of existing and new revenue streams, in a saturated market.

Launch of National Enterprise Hub: this new all-of-government service was launched recently by Minister for Enterprise, Trade and Employment, Peter Burke TD. It’s staffed by experts and trained advisors with the aim of helping businesses access a range of government supports. For the first time a service had been put in place that brings together all of the various 180 supports (such as grants, loans, funding, government schemes and expert advice) across 19 different government departments and state agencies, all accessed through one portal. In short, it’s a one-stop-shop to make it easier for entrepreneurs and business leaders to access available supports. For more information click here

Grow Digital: Minister of State for Trade Promotion, Digital and Company Regulation, Dara Calleary TD recently launched a new website that allows businesses to take an assessment which then provides them with a digital scorecard. They also get advice on the various supports available to them to improve their offering and through digital technologies. Grow Digital has lots of case studies with various digital success stories from a range of different businesses, showcasing how they have embraced digital solutions to boost their operations. The launch of Grow Digital is a key deliverable under Harnessing Digital, Ireland’s National Digital Strategy. For more information click here

Cyber Readiness Institute (CRI): It was launched in 2017 and is based in the United States. Its founding partners are Mastercard, Microsoft, The Centre for Global Enterprise and PSP Partners. It was set up with a view to creating and developing free resources to improve cyber readiness among small and medium sized enterprises (SMEs), while securing global value chains. This resulted in the creation of the Cyber Readiness Program that guides SMEs to become cyber ready. It is a free program that will help make businesses safer, more secure and help defend against cyber threats. It also provides excellent tips and advice to help educate employees to know what it means to be cyber ready. To access this free program or for more information, click here

Funding Activity

- Funding international expansion continues to be a key driver behind much of the activity we are seeing and we expect this to continue through the remainder of the year.

- Refinancing of alternative lenders is also a key driver, as founders seek to reduce their cost of capital to bring repayments back to typical senior debt levels.

- MBOs and continued consolidation across the Managed Service Providers space has been a feature of the year so far repeating the trend of recent years, with similar deals in the pipeline that will drawdown over the coming months

AI – creating a strategy for business

There has been so much ‘noise’ associated with AI of late, one would be forgiven for being overwhelmed as to how and what a company can use it for, or if they need it at all.

Much of the narrative continues to focus on whether it will replace humans and take their jobs.

Recently we have heard from customers across different sectors looking for advice on how they can begin to integrate AI in their businesses.

Thus, below I set out a step-by-step approach that could help companies craft an AI strategy for their business.

Click here to read: 7 steps to create an AI strategy for your business

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple