As GenAI transforms the business landscape, the demand for talent among Ireland’s indigenous tech sector remains robust says Paul Swift, head of Technology, Media and Telecoms Sector at Bank of Ireland.

“As Generative AI applications, such as ChatGPT are increasingly used to solve lots of our everyday challenges, I think it’s fair to say that the days of starting any task, ideation or brainstorming session with a blank sheet of paper are well and truly behind us”

Despite the negative sentiment in relation to job losses among ‘big-tech’ during 2023, the demand for talent among Ireland’s indigenous tech sector remained robust, that said, the challenge of recruiting candidates with relevant skills remains

As Generative AI applications, such as ChatGPT are increasingly used to solve lots of our everyday challenges, I think it’s fair to say that the days of starting any task, ideation or brainstorming session with a blank sheet of paper are well and truly behind us. Expect to see further adoption of these technologies throughout 2024 across every sector.

This edition also provides some perspective on the latest trends across each of the subsectors with a focus on digital advancement, the impending AI Act and the threat of disinformation and deepfakes.

Summary

Technology

Despite the continued negativity in the media surrounding job losses in ‘Big Tech,’ the demand for tech talent remained robust, with Cybersecurity and AI professionals in particular, being in high demand. While there might be a perception that businesses have stalled their hiring plans in light of layoffs announced by ‘big-tech’, there is evidence to suggest that for some businesses it’s about managing and making-do with their current crop of talent. As competition for candidates continued, some businesses have chosen to re-evaluate their hiring needs, as it was becoming a distraction. We continue to hear from customers that, where there has been a supply of candidates, the issue remains, many do not have the relevant skills-set or experience.

Overall, the sector has performed well in 2023. Consolidation continued across the technology managed services space continuing the trend of recent years. In the context of M&A activity, valuations stabilised, with the general consensus that founders have refocused attention on sustainable growth, underpinned by a strategic focus on profitability and tight cost controls.

Media

Across the media space, we have seen further consolidation through acquisition by new and traditional media companies to stay relevant, expand their audience, enhance digital capabilities, create new/diversify their revenue streams, while maintaining a competitive edge in a rapidly evolving media landscape. DMG Media Ireland (BusinessPlus.ie, Evoke, Extra.ie etc) continued on its acquisition trail in 2023, acquiring Everymum which is one of Ireland’s leading parenting websites. While the Business Post acquired Red C, the research and polling company.

Diversification and the acquisition of established online brands can quickly bolster digital presence across a broader target audience when compared to building new platforms from scratch. Furthermore, it can offer more targeted advertising opportunities to advertisers. This in turn boosts revenue generation and competitive edge, through offering unique content and perspectives that differentiate them from other news outlets/traditional media.

Telecoms

Latest available data published by ComReg last December shows that 5G mobile subscriptions increased 69% year on year, comprising a total of 1.4m mobile broadband, voice and machine to machine subscribers. These statistics appear to support the findings of a survey conducted by Bearing Point during 2023, that when compared to the EU averages, Ireland demonstrates a high awareness of the benefits that 5G can bring. The survey also suggested that users in Ireland are also inclined to pay a higher premium for 5G compared to their European counterparts.

2023 Key Sector Trends

ChatGPT chatbot 1st birthday: it’s fair to say a lot has changed since it burst on the scene in late 2022. One thing is for sure, the days of starting any activity with a blank sheet of paper are well and truly behind us. The potential is infinite, where one can seek ideas about anything from generating concepts for a new business; a side hustle to generate extra income, or how to simply improve a CV, which are then produced in moments, notwithstanding the potential hallucinations it can present. Recent further developments have seen ChatGPT being able to hear, see and speak, enabling voice conversations through its mobile application.

Speaking with a contact of mine recently he told me how he knew of a founder of a tech business that is in fundraising mode, who took a spin in his car on a Sunday morning and had a conversation with ChatGPT, about all things related to raising funds for his business. It provided insights on what he should do to prepare, who then to talk to, what a term sheet would look like, negotiable and non-negotiable items, along with the ability to generate charts and data. The interesting thing here is that following his conversation with the app, the founder saw no need to engage an intermediary and the associated costs. There is no doubt that the technology is not perfect, but it paints quiet a startling picture of how fast the landscape is changing and how even highly skilled, professional roles, will be impacted too, much sooner than originally thought.

The Sphere bringing virtual reality to life…without the goggles: whether you’re a fan or not, U2’s residency at the Sphere (which reportedly cost €2bn+) in Las Vegas, both launched and heralded a new era in live entertainment in a computer-generated, immersive experience. What makes this really interesting is that while companies, such as Meta, thought users wanted to wear goggles and join the Metaverse, this instead allows users to experience virtual reality and the shared atmospherics of a live event, without the associated headgear. The Sphere brings virtual reality to life, without the goggles. The Sphere itself, is the world’s largest spherical structure at 516 feet wide and 366 feet tall, coupled with the highest resolution LED screen on earth that can project any form or content. It is powered by a range of technologies, using humanoid robots, AI and patented technology to deliver, a unique immersive sound experience, using wave-field synthesis. For the uninitiated, this allows the Sphere to beam precise, clear sounds to any part of the venue, known as beamforming. This lets them have control over what people hear and where, based on where they are sitting. Different sounds can be enabled in various parts of the audience or isolated at various stages during a show; the applications/uses are infinite. From an attendee’s perspective, they get to experience the event as though they are wearing headphones, but without the need for same. The Sphere can accommodate 17,600 fans; of which 10,000 sit in specially designed haptic chairs (similar to type of gaming chair that has a speaker(s) built-in), that enhance the immersive experience. Other experiential elements allow for sensory stimulus such as feeling hot/cold air or aromas to be projected to these chairs, incidental to what’s happening in the show. Virtual reality, IMAX and a sensory immersive experience, all rolled into one.

So, what does all this mean for the future of live entertainment? In the development phase of The Sphere over 60 patents have been filed with an expectation this could surpass the 100. These patents one would expect will be commercialised into various offerings/technologies/services, which will be licenced to recoup the cost of the investment. As a first step, learnings/advancements in beamforming audio systems at the Sphere could be deployed in a stadium near you, before too long. It has also demonstrated a solid use case for the actual deployment of virtual reality technology.

Live action/Animation future: Irish media and entertainment sector continues to thrive; testament to the world-class storytelling, producers, crews, artistry and technology of the creative industry. Many of the Ireland’s foremost producers of content were showcased at Marché International des Programmes de Communication or MIPCOM annual trade show held in Cannes at the end of last year. MIPCOM is renowned as one of the largest media and TV professionals trade events and plays host to the world’s top content distributors and studios. Ireland’s Creative Sector continues to grow in stature for the quality and reputation of its storytelling, with strong demand, in particular, for original intellectual property. According to Enterprise Ireland, the growing Irish media and entertainment sector is set to be worth a staggering €6.14bn by 2026. In order to maximise this opportunity and build on success to date, the Cultural & Creative Industries Skillnet in collaboration with the sector continues to design and develop the relevant skills and talent development programmes to address the ongoing needs of the cultural & creative sectors. The training programs are subsidised in areas such as Animation, Visual Effects, Games, Film, TV, Immersive Technologies, AR/VR, Virtual Production and Digital Media to name a few. These courses are at the intersection of creativity and technology that might be of interest to those looking to straddle both or seeking to tap into opportunities in this burgeoning sector.

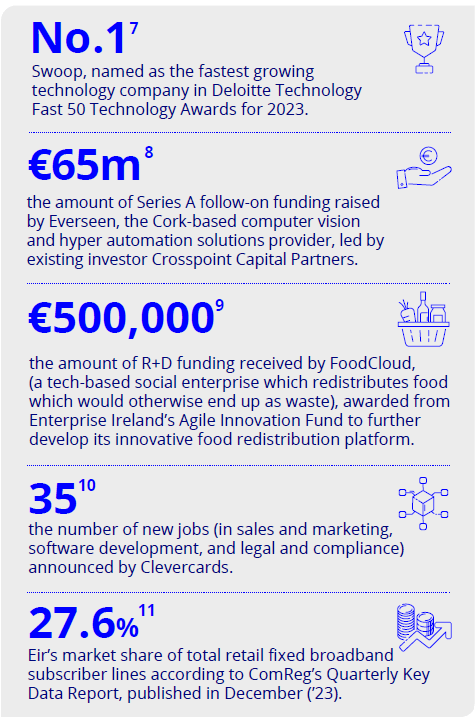

Key activity in the Sector

M&A

Softbank acquires controlling stake in Cubic Telecom: one of the biggest tech stories of 2023 announced at the beginning of December that Softbank Corp, the telecoms arm of the Japanese tech investment giant was taking a 51 percent stake in Cubic Telecom. The investment was €473m, valuing the business at over €900m. This is wonderful news for Barry Napier who is staying on as CEO and all the team at Cubic and provides them with enhanced access to showcase their connected vehicle technologies in the Asian automotive industry. According to an article by McKinsey by 2030, 95 percent of new vehicles sold globally will be connected. This augurs well for Cubic Telecom with lots of potential to grow further in the time ahead.

Mail Metrics completes acquisition of Dafil: Mail Metrics, the customer communications platform provider acquired print and billing communications provider Dafil, their third acquisition since 2021, They have strong ambitions to be the market leader across regulated industries, such as financial services and utilities in Ireland and UK markets, with further expansion into the US probably not too far behind. The business has grown rapidly in recent years where revenues numbers have increased from €1 million in 2019 to a projected €40 million at the end of 2023. Growth through acquisition has enabled the business to rapidly acquire customers in regulated markets providing significant opportunities to upsell its technology suite, shortening the lead time and increasing revenues over recent years. Mail Metrics have won several awards recently including being placed on the Deloitte Technology Fast50 Awards list, the Deloitte FSI Awards and Nick Keegan, CEO has recently been shortlisted for the EY Entrepreneur of the Year 2023.

Recent investment in the sector:

Latest available data from the Irish Venture Capital Association painted a stark picture as funding into Irish SMEs fell by almost 40% to €190m in the third quarter of 2023, down from €309m in the same period of the previous year. What is most alarming from this data was that the value of deals across all sizes fell significantly. For example, during the period, the value of deals between €3-€5m fell by 34% to €193.8m down from €300m for the same period in 2022. More worryingly, the value of deals between €5-€10m fell by 76%. The trend of Ireland receiving significant investment from international funders in recent years was reversed, falling in value by 69%. The largest deal during the period was the announcement of a €60m investment in Ocuco, the global leader in eyecare software solutions, by Accel KKR, to boost global expansion plans and demand for their omnichannel, cloud-based solution.

Delta Investments for 2023

On a more positive note, Delta Partners continued to invest in seed and early-stage technology start-ups. Bank of Ireland and Enterprise Ireland are cornerstone investors in this fund along with Fexco and several family offices. Investments during 2023 included:

Kayna: a Cork based startup providing embedded insurance infrastructure solutions that enable insurance carriers and brokers to embed their insurance products within any vertical SaaS platform to offer insurance products to their SME customer base, secured an investment round with participation from Delta Partners. Kayna’s technology enables carriers and brokers to access a unique data set to ensure SME’s get more accurate insurance, while significantly reducing their own distribution costs of serving the SME market.

Recruitroo: a Dublin based startup that is building a software platform that will manage the process of semi-skilled workers from outside the EU into roles within the EU secured a new investment led by Delta Partners. Dealing with visas, work permits, national insurance numbers, travel and accommodation etc. Recruitroo automates the process and reduces paperwork to get semi-skilled workers into roles faster.

Tailr: a Waterford headquartered startup that provides a platform for fashion brands and manufacturers to streamline production processes, secured €700K in investment, led by Delta Partners. With Tailr, fashion brands can reduce sampling time and ensure consistent sizing which ultimately reduces ecommerce returns and landfill.

TMT 2024 Outlook

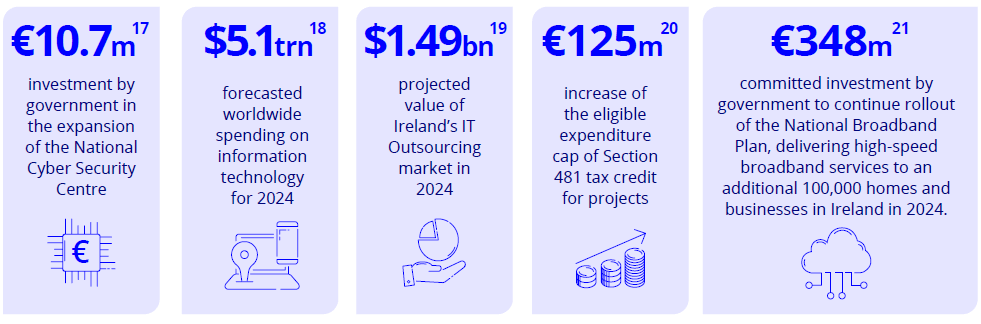

As government recently approved guidance on the use of AI in the public service, the responsible and ethical use of this and other technologies will come into sharp focus for SMEs during 2024, along with how to integrate and optimise opportunities, presented by the technology.

Technology

Digitalisation continues and businesses from every sector need to be able to work with and become data driven. Given the dearth of skilled and available talent to meet the needs of business, this will continue to drive upskilling and re-skilling initiatives. The days of employees claiming to not know anything about information technology are also behind us, every employee needs to embrace a digital mindset to develop competencies in digital problem solving, understanding of data and continuous learning. We are likely to see a step change from government to drive digital upskilling over the course of this year.

Media

The sector is forecasted to grow to €6.14bn by 2026, largely driven by a significant uplift in internet advertising. Market penetration is through smart phones, with increasing amount of advertising channelled through apps and in association with the surging podcast market. This will drive further consolidation in the sector this year. Traditional media, particularly more regional titles continue to struggle to gain share from advertisement investment as larger content providers seek to increase their share/consolidate of advertising spend by syndicating content, while moving these businesses online and moving to a subscription model. In a report published by Coimisiún na Meán in 2023, showed that the percentage of those who have subscribed to any form of online news site has shifted slowly from 7% (2015) to 12% (2019) to 15% (2023), with the highest percentage of subscribers being in the 25–34-year-olds (21%). What does this mean for the sector for the year ahead, lots of opportunity but also some work to be done to convince more subscribers to go beyond the paywall.

Telecoms

Recent findings from a Bearing Point alluded to earlier, it is likely that we will see various initiatives to encourage more subscribers and increase adoption of 5G in Ireland given the apparent willingness of customers to pay more for the service. Expect to see lots of advertising campaigns across this year highlighting all the associated benefits. Further consolidation is also likely and with news of Macquarie Capital Principal Finance making a strategic investment in Viatel Technology Group last December, safe to say we will hear of more announcements as they continue on their acquisition trail of recent years.

Market

Digital advancement

Whatever one’s preference, whether it is OpenAI’S ChatGPT, Google’s Gemini Ultra or Anthorpic’s Claude 2, the reality is generative AI will accelerate further over the coming year. These technologies will become integrated into many sectors from the legal industry to health diagnostics and broader manufacturing industry. Big data now has a support tool to enable businesses to glean insights and make predictions much quicker than in any time in the past. Leadership teams can evaluate various scenarios and plan contingencies in moments as opposed to weeks and months. In short, the hype is over, the focus will on be harnessing the power of the technology as a tool to augment and support the work that humans do, as opposed to replacing them.

Virtual wards

Digital health will also come into sharp focus this year as the HSE launches its Virtual Wards programme. University Hospital Limerick and St. Vincent’s University Hospital, Dublin have been chosen to roll out the programme initially, with other sites expected later in the year. This is the beginning of telehealth at scale in Ireland, with remote monitoring of patients through a range of connected devices. Physical ward rounds in hospitals will be replaced with home visits or video calls. Personalised monitoring of each patient is based on individual alerts and protocols so that any deviation or deterioration in a patient’s condition is acted upon accordingly. Over time many different illnesses are expected to be managed through virtual wards. This will create new opportunities for start-ups and scaling businesses across Ireland that are building various solutions for the future of connected health, to trial/roll out their solutions.

EU AI Act

Agreement among EU members was reached between the European Parliament and the Council on the Artificial Intelligence Act (AI Act) in early December. The Act aims to establish a legal framework for AI, focusing on transparency, accountability, and ethical use of AI. The AI Act applies to all AI systems impacting people in the EU and applies across all sectors. The Act sets the tone as a global landmark for AI regulation is a reflection of how the EU is seeking to lead the way in creating legislation to set out the guidelines on what trustworthy and responsible use of AI looks like. The Act is expected to come into force during Q3 or Q4 this year, with enforcement of prohibitions six months after that date.

Disinformation and deepfakes.

More than half the world’s population (and GDP) or more than 40 countries will vote during 2024 with the United States, Pakistan, European Union, Russia and potentially the UK all in election mode. One of the most pressing challenges is the threat of disinformation. Synthetic content such as AI generated media and deepfake videos, audio and images also have the potential to spread disinformation. There has been a 10-fold increase in the amount of synthetic content/deepfakes detected globally from 2022 to 2023: 1740% deepfake rise in North America, 1530% in APAC, 780% in Europe (inc. the UK), 450% in MEA and 410% in Latin America. Hence, we are likely to see an acceleration in the creation and development of technologies that can identify and mitigate the effects of disinformation. It is critical that robust tools are developed to combat the threat caused by synthetic content, not only to maintain integrity of digital communications but to protect and preserve trust in society.

Funding Activity

Digitalisation and the adaption and adoption of AI technologies is likely to increase during 2024 providing opportunity for software development and managed services business in the roll out of these technologies.

The sector had gone through a correction over the last 18 months and businesses are now more focused on growing sustainably and building profitable businesses, rather than pursing top line growth to enhance their overall enterprise value. We would expect to work with businesses of this type to support their growth ambitions during the year.

While there has been an increase in the volume of alternative lenders in the market over recent years, we would expect to see businesses that have matured over recent years seek to refinance their existing debt to reduce their cost of capital over the coming months.

The Sectors Team is a differentiator for Bank of Ireland in that the sector heads are recruited directly from industry and bring perspective that only first-hand experience can provide. To learn more about Bank of Ireland’s sectoral expertise, click here